Staying the course amid uncertainty in Europe

Amid rising volatility triggered by the Ukraine war, Sam Morse and Marcel Stötzel, portfolio managers of the Fidelity European Trust PLC, review the current market dynamics across regional equity markets. In particular, they highlight why their focus on building a balanced portfolio of robust dividend-payers should be well positioned to deliver attractive long-term returns.

We have had a turbulent start to the year, with the Ukraine war and accompanying sanctions on Russia threatening to impact economic growth in Europe. As the tragic humanitarian costs of the war continue to unfold, our first thoughts are for the suffering of the Ukrainian people.

Although the portfolio does not have any direct investments in Russia and Ukraine, the second order effects of the war are being felt given both countries are major suppliers of a wide range of agricultural and commodity products. More limited supply of these could exacerbate inflationary pressures worldwide, as could any disruption to Russian oil and gas exports.

On the positive side, the improving outlook on Covid-19 vaccination rates should help European economies continue to reopen and normalise. Moreover, Europe has a strong export sector and is therefore poised to benefit from the global recovery. The region is also home to many companies in the technology and consumer sectors that we believe could be well placed to drive the next decade of innovation.

The most obvious example comes from the European tech sector where we see companies such as Dassault Systèmes and ASML continuing to be amongst the most innovative companies globally.

However, another example is European consumer goods companies which are at the leading edge when it comes to the latest tech buzzword – the “metaverse”. Put simply, the metaverse is a network of 3D virtual worlds that is facilitated by the use of virtual and augmented reality.

Examples of European innovations include: EssilorLuxottica partnering with Meta (formerly Facebook) on augmented reality Ray-Ban sunglasses and Gucci (part of Kering) and Roblox partnering to offer digital outfits.

While these initiatives are currently small, some experts are forecasting that over the coming decade digital purchases could account for 25% of luxury goods sales, which given the high margins these products have would be very meaningful for share prices.

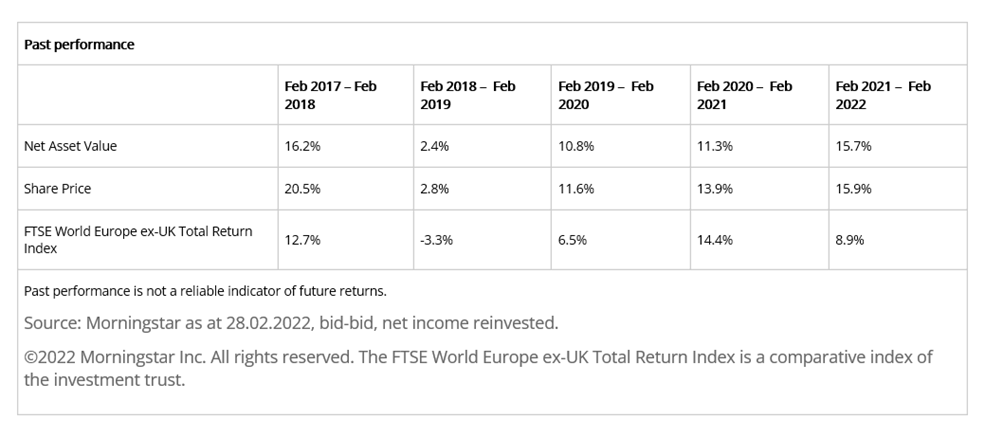

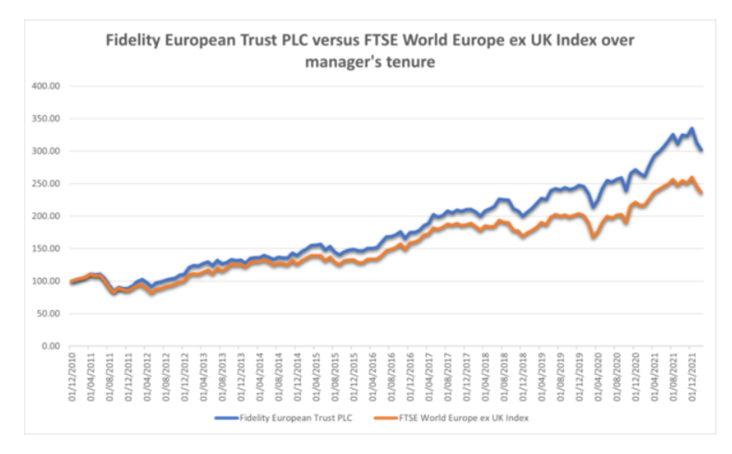

While the outlook for Europe may be more uncertain, the portfolio has performed strongly over the last year on both a relative and absolute basis, helped by the rising tide of earnings and dividends, coupled with the strong liquidity from supportive monetary policy.

Staying invested

There are many lessons we have learnt from previous volatile periods. Like so many things in life, it is often two steps forward and one step back. We must avoid being overly bullish when optimism is on the rise and we must avoid being too despondent when bad news surfaces. Put simply, it pays to stay invested whatever the headlines.

We do not try to predict which uncertainties will become realities. We do, however, try to build a balanced portfolio, where stockpicking – and our focus on attractively valued dividend growers – will drive the performance of our portfolio over time. In this regard, it is important to recognise that a lasting effect of the pandemic is that it has encouraged European companies to pursue greater innovation and efficiency which will result in growing dividends for investors on a multi-year view.

Each individual stock position is, of course, subject to macroeconomic factors, but the advantage of diversification is that exposure can be dampened through portfolio construction, allowing idiosyncratic elements to determine performance. Clearly, sometimes we face stylistic headwinds in the short-term.

Our preference for steady growers, sometimes tagged as bond proxies, can mean we face a headwind to performance when inflation expectations or bond yields rise. Over the long-term, however, these factors even out and relative performance, good or bad, is primarily a function of stock-picking.

Our focus on attractively valued dividend growers with strong balance sheets has remained a key feature of the portfolio as has the rigorous approach to stock selection. These factors have benefited investors across a range of market conditions over the years and we believe that it will continue to do so in the future.

More information about Fidelity European Trust here >

Fidelity European Trust is one of only 20 investment companies selected by AJ Bell’s investment specialists for their Investment Trust Select List.

In an interview with Shares Magazine Sam Morse, Lead Portfolio Manager and Marcel Stötzel, Co-Portfolio Manager at Fidelity European Trust PLC, discuss their roles within the fund, the funds’ investment process and how this differentiates it from its wider peer group. They also talk us through generating ideas for the fund and how it has performed over the last 5 years.

Important information

The value of investments and the income from them can go down as well as up, so you may get back less than you invest. Investors should note that the views expressed may no longer be current and may have already been acted upon. Overseas investments are subject to currency fluctuations. Fidelity European Trust PLC can use financial derivative instruments for investment purposes, which may expose it to a higher degree of risk and can cause investments to experience larger than average price fluctuations. The shares in the investment trust are listed on the London Stock Exchange and their price is affected by supply and demand. The investment trust can gain additional exposure to the market, known as gearing, potentially increasing volatility. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only.

The latest annual reports, key information document (KID) and factsheets can be obtained from our website at www.fidelity.co.uk/its or by calling 0800 41 41 10. The full prospectus may also be obtained from Fidelity. The Alternative Investment Fund Manager (AIFM) of Fidelity Investment Trusts is FIL Investment Services (UK) Limited. Issued by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0322/370474/ISCSO00067/NA

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.