The under-explored power of listed private equity

Private equity remains off-piste for most investors despite its appeal as a potential core holding…

Disclaimer – Disclosure – Non-Independent Marketing Communication This is a non-independent marketing communication commissioned by NB Private Equity Partners. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

- Despite having over more than $5 trillion of assets under management – private equity remains a peripheral holding for many smaller investors. However, far from its current role as simply a ‘satellite’ allocation for some, Neuberger Berman believes private equity should be considered a permanent ‘core’ holding in investor portfolios.

- The universe of private companies has continued to grow, therefore, investors ignoring private markets are missing access to a significant investment universe, possibly limiting both diversification and return potential.

- Listed private equity trusts provide liquid access for investors to the asset class and its compelling long-term return potential.

Global private equity has experienced a staggering rise over the past two decades, with the market recording a tenfold increase in total assets, which was almost three times the growth of the public equity market over the same period.

Despite having more than $5 trillion of assets under management private equity remains a peripheral holding for many smaller investors. However, far from its current role as simply a ‘satellite’ allocation, Neuberger Berman believes private equity should be considered a ‘core’ holding in investor portfolios.

Alongside the sheer growth of private equity’s investable universe, a key driver of its evolution towards becoming a core portfolio component has been the value it has created outside public markets. Public market investors may be feeling the knock-on effects. In addition to the reduced choice due to the decline in number of public companies over the long term, public market investors are also often accessing companies at a later stage, if they can access them at all. This could potentially impact both diversification and overall return potential.

Expertise that enhances value

According to the latest data available from Preqin, more than $680bn was raised by private equity in 2021, a 26% increase on the previous year and a nearly four-fold increase on 2010. Institutional investors such as pension funds and endowments are continuing to allocate significant capital to the asset class.

While private equity allocations typically range between 8-13% for the more active UK pension funds, this still often lags US institutional investors, with notable examples with particularly high allocations including the endowments of Yale and Harvard, which have an allocation of 38% and 34%, respectively.

In addition to accessing a wider investment universe and the associated diversification benefits, a key aspect of private equity’s appeal is the historic return outperformance relative to listed equity markets.

A primary factor behind this outperformance is the ability of private equity managers to generate growth through operational and strategic change. As control investors, private equity managers work closely with portfolio company management teams to execute value-creation strategies, such as moving into new markets, driving operational efficiencies, or executing M&A opportunities – all of which can result in a meaningful impact to performance.

Control not only allows private equity managers the ability to drive growth, but also allows private equity-backed companies to react to change quickly – whether in the face of economic uncertainty, disruption, or a new competitive threat. Short lines of communication, alignment of interests and access to capital can make these businesses nimbler than many public market equivalents.

NBPE’s manager, Neuberger Berman, believes private equity manager expertise will only increase in importance in the period ahead. With markets likely to witness heightened volatility and companies needing to adjust to the current inflationary environment, the ability to generate value may depend to an even greater degree on driving revenue and earnings growth – which can be powered by the insights and expertise of the private equity manager.

Access to Private Equity

Private equity has long been the purview of institutional investors such as endowments and pension funds, primarily due to the relationships needed to source and the expertise necessary to execute investments, the illiquid nature of the asset class and the often very high minimum investment commitments.

However, for investors requiring daily liquidity, the UK private equity investment companies sector enables access to the significant return potential of the asset class, as well as the associated diversification benefits, for the cost of just a share.

NB Private Equity Partners (NBPE) is one such London-listed investment company, managed by Neuberger Berman, an industry leading private equity investor. NBPE co-invests alongside leading private equity managers, leveraging the strength of Neuberger Berman’s platform, relationships, deal flow and expertise, to provide shareholders with access to a diversified portfolio of direct investments in leading private companies, managed by a selection of the world’s premier private equity managers.

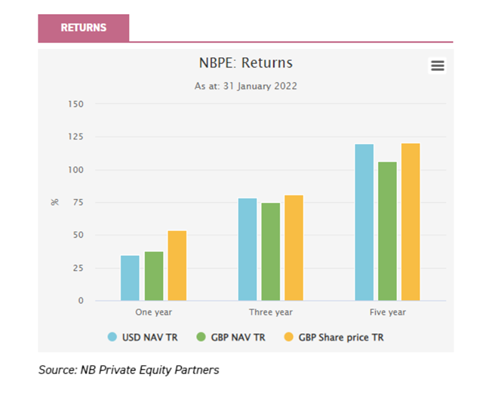

NBPE’s portfolio of 95 companies, valued at $1.5bn, is skewed towards less cyclical businesses and/or businesses expected to benefit from strong secular growth trends. Primarily invested in the US, the world’s largest and deepest private equity market, the NBPE strategy has generated significant returns for investors in recent years.

Click here for the latest research on NBPE >

Important information

Past performance is not a reliable indicator of future returns. The value of investments and the income from them can go down as well as up, so you may get back less than you invest. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Overseas investments are subject to currency fluctuations. The shares of NBPE are listed on the London Stock Exchange and their price is affected by supply and demand and the discount at which NBPE trades could vary significantly based on these factors. NBPE can gain additional exposure to the market, known as gearing, potentially increasing volatility. Investors should note that the views expressed may no longer be current and may have already been acted upon.

1For illustrative purposes only. The benchmark performance is presented for illustrative purposes only to show general trends in the market for the relevant periods shown. The investment objectives and strategies of the benchmarks may be different than the investment objectives and strategies of a particular private fund, and may have different risk and reward profiles. A variety of factors may cause this comparison to be an inaccurate benchmark for any particular type of fund and the benchmarks do not necessarily represent the actual investment strategy of a fund. It should not be assumed that any correlations to the benchmark based on historical returns would persist in the future. Past performance is no guarantee of future results. Indexes are unmanaged and are not available for direct investment.

Source: Private equity data from Burgiss. Represents pooled horizon IRR and first quartile return for Global Private Equity Buyout as of September 30, 2021, which is the latest data available. Public market data sourced from Neuberger Berman.

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.