Solving climate change can be the investment opportunity of our lifetime

By Gabriela Herculano, CEO of iClima Earth Founder of the iClima Global Decarbonisation Enablers UCITS ETF (CLMA)

Solving climate change can be the investment opportunity of our lifetime…if we focus on the companies that bring to market the relevant solutions Solving climate change can be the investment opportunity of our lifetime…if we focus on the companies that bring to market the relevant solutions

The Paris Agreement signed by the world’s nations in 2015 to combat climate change aims to keep the increase in the global average temperature to below 2 °C above pre-industrial levels, and 1.5 °C if possible.

The Agreement has helped drive an increasing focus globally on assessing climate change risks, the impacts of business operations on the environment and how greenhouse gas (GHG) emissions are disclosed.

Several international initiatives, such as the Task Force on Climate Related Financial Disclosure, the United Nation’s Net Zero Alliance and several by the financial industry have all helped accelerate the transition to a low carbon world, rewarding companies that cut emissions while urging them to be more transparent about their impacts on the environment.

However, more action and new approaches are needed. Research (1) by the London School of Economics found, for example, that in a sample of companies generating 40% of global emissions, less than one in five (18%) were cutting emissions at the rate necessary to meet the 2°C target.

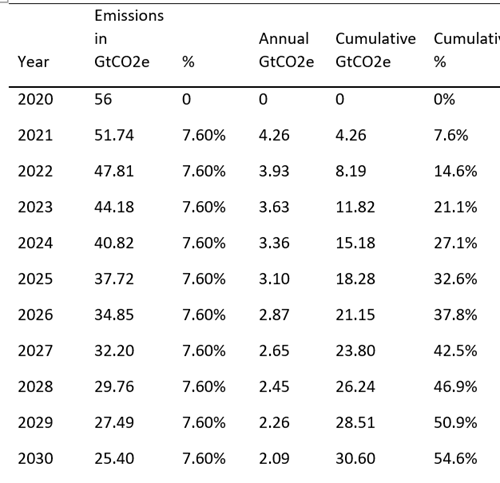

The United Nations (2) estimates the world must cut emissions by 7.6% every year. At present, global emissions are 56 gigatons, which means the world needs a 4.26 gigatons cut over the next year alone. Any delay and the required cut could rise to 15.5% by 2025.

New methods are needed to measure emission cuts

Any shift to a low-carbon world requires new approaches and innovations by companies that help change societal behaviour, and new ways of measuring climate impacts.

Unfortunately, many companies don’t adequately disclose their ‘carbon footprints’ and very few attempt to quantify their emissions; without proper measurement it is hard to track progress, which is one of the reasons we focus on CO2e avoidance, the other side of the coin.

We want to guide investors to those companies that are enabling the transition to a net zero emissions world. Our “climate champions” are companies that provide real solutions to climate change. They provide product and services that enable other companies to reduce their CO2 emissions (CO2e) and have a significant impact that can be measured in terms of ‘CO2e avoidance’.

Investors can help bring about fundamental change by investing in such companies.

iClima helps investors identify companies actively “doing more good” rather than those just “doing less bad” and provide investment products that focus on companies enabling CO2e avoidance.

But how much CO2e avoidance could such solutions deliver?

Defining ‘Avoidance’

‘Avoided emissions’ are reductions brought about by products or services that provide the same or similar functions as existing products - but with significantly less GHG emissions. (3)

They can be expressed in a formula as the difference between GHG emissions from a business-as-usual (BAU) baseline scenario and GHG emissions from a climate change solution scenario:

Net Avoided Emissions = (BAU baseline emissions) - (solutions-enabled emissions)

E.g. a company that switches electricity supplier from a fossil fuel-based provider to one that sources power from renewable resources such as solar or wind projects would achieve net avoided emissions virtually equivalent to the CO2 emitted by its former supplier to generate its energy.

The focus is on suppliers

Companies that have reduced their carbon footprint such as Google and Microsoft are users of key climate change solutions, such as renewable energy, electric vehicles and even plant-based meals served in their cafeterias.

At iClima Earth we focus instead on the suppliers of the solutions; not just because we think these companies can do well financially, given they sell what the world needs to fight climate change and increasing demand for their products, but also because more capital needs to be channelled to the companies in these key segments. Shedding light on these climate champions will direct capital to much needed R&D and innovation.

Fig 1: Annual reductions needed in global CO2 emissions

Different Focus yielding different results

At iClima Earth we have developed a fact-based, data driven methodology to vet the companies that have potential to contribute towards the goal of decarbonising the planet.

We believe that the best way to reduce CO2e in the atmosphere is by not emitting them in the first place: we are driven by the products and services that can enable CO2 avoidance.

We started by looking at the 100 most substantive, technologically viable, existing solutions that can decarbonise the planet as listed by the incredible Project Drawdown, a non-profit organisation dedicated to reducing GHGs in the atmosphere.

We applied our own screening rules to make 360-degree assessments of the environmental impacts of companies and developed a unique equity benchmark, the iClima Global Decarbonisation Enablers Index, managed by Solactive.

We have spent over 15 months quantifying the CO2e avoidance that each company in our Index can generate from annual sales. We look at the solutions to assess those that are transient (such as a plant-based Beyond Meat burger, or a telepresence call on Zoom) and those that are based on products with long useful lives (such as a Siemens Gamesa wind turbine, or a Tesla electric vehicle (EV) car).

Key for us is the comparison of what the companies in our index can potentially avoid in CO2e emissions in 2021 to the amount of CO2e that needs to be avoided in the year.

Our iClima Global Decarbonisation Enablers Index is currently comprised of 151 companies. The products and services they represent fall within five categories (Green Energy, Green Transportation, Sustainable Products, Enabling Solutions and Water & Waste Improvements). We estimate they will contribute to more than 0.6 gigatons of the new and recurring CO2e avoidance in 2021.

These companies supply relevant climate change solutions; using the California goldrush analogy, they are the companies supplying the shovels.

We see tailwinds supporting these climate champions coming from global agreements and targets combined with green stimulus and policies and a positive shift in consumer behaviour.

This helps to explain the strong performance of our Total Return Index, which is up 63.6% so far this year (4). Investors can invest in the Index through the iClima Decarbonisation Exchange Traded Fund.

Reducing carbon footprints

Users of the products and services sold by the constituents of iClima index can reduce their carbon footprint based on several measures.

For example, ‘Scope 1’ is defined as direct emissions from a company’s facilities and vehicles. In our EV solutions subsegments, we have companies such as Workhorse

or Aptiv that could help an e-commerce player embrace zero carbon emission delivery solutions based on electric trucks, or EV makers such as Tesla to reduce the emissions of the company’s own fleet of cars.

‘Scope 2’ is defined as indirect emissions embedded in the energy sourced by a company. This is where many companies have been able to lower emissions, by sourcing electricity from renewable sources. iClima’s benchmark has several global and more local asset owners of renewable energy projects including Iberdrola, NextEra Energy, and Orsted, among others.

Finally, ‘Scope 3’ are emissions from both upstream and downstream activities, such as emissions from goods and services purchased, business travel, waste generated in the company’s operations, emissions that take place in the use of the products sold and end of life treatment of the products sold.

Although Scope 3 is the hardest measure to assess, it provides the most accurate picture of a company’s carbon footprint, and therefore the true extent of their emissions avoidance.

Looking ahead

The time has come for the world to quantify CO2e avoidance, and we hope to contribute to this task by providing our own framework of potential CO2e avoidance through the companies in our index.

We are stepping on the shoulders of the great minds behind Project Drawdown and other thought leaders to provide our own carbon avoidance benchmark, and we hope CO2e avoided emissions will become a widely used metric in the battle against global warming.

Gabriela Herculano is the founder of the iClima Global Decarbonsiation Enablers UCITS ETF. When you trade ETFs your capital is at risk.

(1) Source: The Grantham Research Institute on Climate Change at the London School of Economics, commissioned by the Transition Pathway Initiative, 2020

(2) Source: UN Environment Programme Emissions Gap Report 2019

(3) Source: (Avoided Emissions Framework, 2019)

(4) Year to date in sterling terms, as of 2 December 2020

More information on iClima Global Decarbonisation Enablers UCITS ETF here >

To buy this trust login to your EQi account

iClima Global Decarbonisation Enablers UCITS ETF (CLMA) - IE00BNC1F287

Important Information:

Communications issued in the UK

The content in this document is issued by HANetf Limited (“HANetf”), an appointed representative of Mirabella Advisers LLP, which is authorised and regulated by the Financial Conduct Authority (FCA FRN 606792). HANetf is registered in England and Wales with registration number 10697042.

This communication has been prepared for professional investors, but the Exchange Traded Funds (“ETFs”) set out in this communication may be available in some jurisdictions to any investors. Please check with your broker or intermediary that the relevant ETF is available in your jurisdiction and suitable for your investment profile.

Past performance is not a reliable indicator of future performance. The price of the ETFs may vary and they do not offer a fixed income.

This document may contain forward looking statements including statements regarding our belief or current expectations with regards to the performance of certain assets classes. Forward looking statements are subject to certain risks, uncertainties and assumptions. There can be no assurance that such statements will be accurate and actual results could differ materially from those anticipated in such statements. Therefore, readers are cautioned not to place undue reliance on these forward-looking statements.

The content of this document does not constitute an investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment. An investment in an exchange traded product is dependent on the performance of the underlying asset class, less costs, but it is not expected to track that performance exactly. The ETFs involve numerous risks including among others, general market risks relating to underlying adverse price movements in an Index or underlying asset class and currency, liquidity, operational, legal and regulatory risks.

The information contained on this document is not, and under no circumstances is to be construed as, an advertisement or any other step in furtherance of a public offering of securities in the United States or any province or territory thereof, where HANetf ICAV or their ETFs are authorised or registered for distribution and where no prospectus of HANetf ICAV has been filed with any securities commission or regulatory authority. No document or information on this document should be taken, transmitted or distributed (directly or indirectly) into the United States. HANetf ICAV, nor any securities issued by it, have been or will be registered under the United States Securities Act of 1933 or the Investment Company Act of 1940 or qualified under any applicable state securities statutes.

HANetf ICAV is an open-ended Irish collective asset management vehicle issuing under the terms in the Prospectus and relevant Supplement approved by the Central Bank of Ireland (“CBI”) (“Prospectus”) is the issuer of the ETFs. Investors should read the current version of the Prospectus before investing and should refer to the section of the Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in the ETFs. Any decision to invest should be based on the information contained in the Prospectus.

The Prospectus can all be downloaded from www.hanetf.com.

The decision and amount to invest in any ETF should take into consideration your specific circumstances after seeking independent investment, tax and legal advice.

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.