The outlook for UK income

Iain Pyle, Investment Manager, Shires Income PLC

- The UK market’s reputation for dividend strength took a knock in 2020

- A skeleton Brexit deal and economic recovery favour income holdings

- Active management and a focus on quality have been vitally important

UK companies have a rich history of paying dividends to shareholders and historically, the UK market has been a secure and fertile place to hunt for income. This reputation has taken a knock in recent years, as interest rate policy, then Brexit and finally the pandemic has seen the UK equity income sector lag its peer group. However, the outlook for the sector has markedly improved since the start of the year.

Delivering resilient income in a tough year

Perhaps first, it is worth looking at why UK equity income has struggled. Brexit has certainly put pressure on UK companies and has also seen global investors steer clear of the UK market.

The pandemic brought new pressures: by the end of 2020, around 45% of companies had suspended their dividends and overall income was back to where it was a decade ago. It exposed companies that had been over-distributing at the expense of business investment.

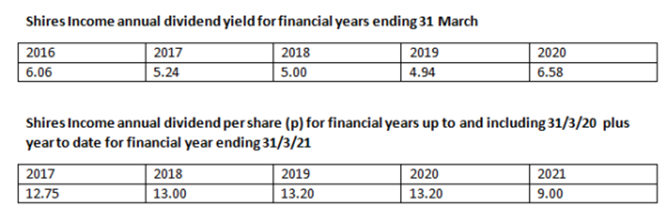

In this environment, certain elements have been important. Our focus on quality companies has given us a greater margin of safety and helped us avoid the worst of the dividend cuts. By the end of 2020, dividends in the Shires portfolio were down 13%, around one-third of the hit from the wider FTSE 350 index.

‘the outlook for the sector has markedly improved since the start of the year’

Active management has also been important. Our team covers every company in our FTSE 350 benchmark and it means we have someone watching every stock. This gives us the best chance not only of finding the right income stocks for Shires, but also ensures we are alert to any change in outlook.

As part of this active approach, it has also been important to understand why companies are cutting dividends: have they been forced to suspend dividends by the regulator, for example, as was the case with the banks?

Is the damage to their business likely to be short-term? Here, we would look at companies such as Euromoney, where the events business was badly damaged but should revive as life returns to normal.

Then, there were areas where we felt the deterioration was likely to be longer-term in nature and we needed to sell the holding. These measures have helped ensure our investors haven’t felt the full force of difficult market conditions.

Changing market conditions

While we do not define ourselves as ‘value’ investors, income investing tends to have a natural tilt towards value. Low interest rates have been a headwind for the ‘value’ style in recent years and growth companies have performed notably better. The clearest evidence has been the strong performance of high growth technology companies.

‘the success of the vaccine rollout gives the UK a real chance to get back to normal before anyone else and recover quicker'

The vaccine announcements have brought some expectation of economic recovery and with it, a rotation into more economically sensitive parts of the market. Inflation expectations have pushed bond yields higher. This has benefited the UK market and income stocks more generally.

While we wouldn’t suggest a wholesale shift in investor portfolios, investors can no longer rely on bond yields moving ever lower. We’re now in an environment where stock-specific considerations may matter more.

We also believe the UK may finally start to reverse its weakness since the Brexit referendum. Since 2016, there has been a lingering nervousness about how UK comes out of the EU, how the deal is shaped and what it means for the country. This has been seen in the weak performance of the UK currency and in a lack of business investment. The deal is far from conclusive, but it puts the period of significant uncertainty behind us.

It is not just the absence of these headwinds that augers well for the UK. There are also some positive tailwinds. For example, the UK market remains at a material discount to its international peers, in spite of some stronger performance more recently. Equally, the success of the vaccine rollout gives the UK a real chance to get back to normal before anyone else and recover quicker than other countries.

Unemployment has remained low compared to previous recessions, while household savings levels are high. We believe these savings may find their way into the economy later on this year.

Our portfolio

In spite of dividend cuts last year, the gap between the income on equity and bonds remains at a very high level. At the same time, the stock market should provide greater scope for capital growth and has historically been a better hedge against inflation.

Given the uncertainties inherent in today’s environment, we are striving for balance in the Shires portfolio.

The companies we hold generally fall into three areas: those that deliver consistent growth over time, independent of the broader economic environment; valuation opportunities; and those companies that are more defensive and offer resilient income.

‘dividends are a vitally important component of shareholder returns’

Over the last 12 months, we have been adding a little more to ‘value’ holdings where valuations are more appealing.

In the longer term, dividends are a vitally important component of shareholder returns. The type of high quality companies we hold in the portfolio should deliver a sustainable, growing income and can trade on a premium rating because of that quality.

Those companies with financial strength should be in a better position to take opportunities, conduct merger and acquisition activity and grow faster in today’s market.

Companies selected for illustrative purposes only to demonstrate the investment management style described herein and not as an investment recommendation or indication of future performance.

Find out more about Shires Income PLC >

To buy this trust login to your EQi account

Select Shires Income PLC – GB0008052507

Important information

Risk factors you should consider prior to investing:

- The value of investments and the income from them can fall and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- The Company may charge expenses to capital which may erode the capital value of the investment.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid-offer spread. If trading volumes fall, the bid-offer spread can widen.

- Certain trusts may seek to invest in higher yielding securities such as bonds, which are subject to credit risk, market price risk and interest rate risk. Unlike income from a single bond, the level of income from an investment trust is not fixed and may fluctuate.

- With funds investing in bonds there is a risk that interest rate fluctuations could affect the capital value of investments. Where long term interest rates rise, the capital value of shares is likely to fall, and vice versa. In addition to the interest rate risk, bond investments are also exposed to credit risk reflecting the ability of the borrower (i.e. bond issuer) to meet its obligations (i.e. pay the interest on a bond and return the capital on the redemption date). The risk of this happening is usually higher with bonds classified as ‘subinvestment grade’. These may produce a higher level of income but at a higher risk than investments in ‘investment grade’ bonds. In turn, this may have an adverse impact on funds that invest in such bonds.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

Other important information: Issued by Aberdeen Asset Managers Limited which is authorised and regulated by the Financial Conduct Authority in the United Kingdom. Registered Office: 10 Queen’s Terrace, Aberdeen AB10 1XL. Registered in Scotland No. 108419. An investment trust should be considered only as part of a balanced portfolio. Under no circumstances should this information be considered as an offer or solicitation to deal in investments.

FTSE International Limited (‘FTSE’) © FTSE 2021. ‘FTSE®’ is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under licence.

Find out more at www.shiresincome.co.uk or by registering for updates.

You can also follow us on Twitter and LinkedIn.

GB-150321-145048-3

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.