Necessary changes in global healthcare systems bring long-term investor opportunities

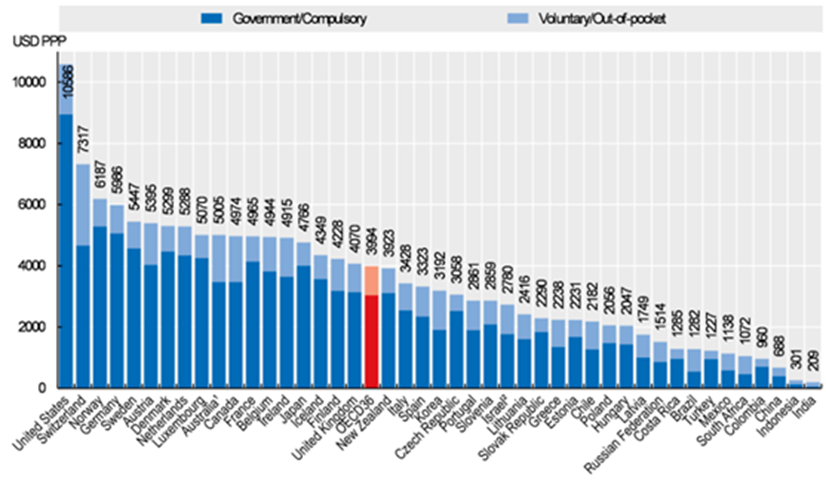

The graph below shows health expenditure per capita across the globe and highlights the enormous difference in spend in the western world compared to emerging markets – by Daniel Mahoney and Gareth Powell of Polar Capital Global Healthcare Trust.

The US, Switzerland and Norway are at one extreme – generating challenges that the amount of spend is too high – while at the other end of the spectrum India, Indonesia and China have problems from spending too little.

The US health expenditure is 50x India’s, on a per capita basis. This is unsustainable. Changes need to happen to reflect this challenge, and there are investment themes that are highly relevant to the outlook ahead for healthcare systems around the globe.

Source: OECD Health Statistics 2019, WHO Global Health Expenditure Database. Note: Expenditure excludes investments, unless otherwise stated. 1. Australia expenditure estimates exclude all expenditure for residential aged care facilities in welfare (social) services. 2. Includes investments.

For the developed world, healthcare systems need to become more productive with the spend they have available. The key opportunities here are disrupting healthcare delivery, innovation and prevention.

For healthcare delivery, shifting the location of care from the in-patient hospital is critical, with increased investment in technology driving this change. Innovation is also key as this should increase productivity.

Ultimately, an increased focus on prevention is the best form of healthcare. From an industry perspective, this drives the themes of consolidation and outsourcing in reaction to the likely changes ahead in the provision of healthcare.

For emerging markets, the expansion of healthcare systems and increased investment drives broad-based bullish trends across the relevant universe.

While complexity in different countries will add challenges to the progression of increased healthcare spending, learning lessons from the history of developed market healthcare systems should provide advantages and the adoption of digital technologies earlier in the expansion of healthcare systems should provide numerous growth opportunities for relevant companies.

This will all take a long time and thus offers a tremendous investment opportunity across the globe. The pandemic has only accelerated the impact of these themes on healthcare and will be our focus for the next 5-10 years

More information on Polar Capital Global Healthcare Trust PLC here >

Important information: The information provided is not a financial promotion and does not constitute an offer or solicitation of an offer to make an investment into any fund or company managed by Polar Capital. It is not designed to contain information material to an investor’s decision to invest in Polar Capital Healthcare Trust plc, an Alternative Investment Fund under the Alternative Investment Fund Managers Directive 2011/61/EU (“AIFMD”) managed by Polar Capital LLP the appointed Alternative Investment Manager. Polar Capital is not rendering legal or accounting advice through this material; viewers should contact their legal and accounting professionals for such information. All opinions and estimates in this report constitute the best judgement of Polar Capital as of the date hereof, but are subject to change without notice, and do not necessarily represent the views of Polar Capital. It should not be assumed that recommendations made in future will be profitable or will equal performance of the securities in this document.

Polar Capital LLP is a limited liability partnership number OC314700. It is authorised and regulated by the UK Financial Conduct Authority (“FCA”) and is registered as an investment advisor with the US Securities & Exchange Commission (“SEC”). A list of members is open to inspection at the registered office, 16 Palace Street, London, SW1E 5JD

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.