This time next year Rodney...

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

We review the performance of the team’s ‘top picks’ for 2020 – including some proper plonkers – and place our bets for the year ahead…

I once sat through a three-hour performance of Samuel Beckett’s Waiting for Godot at the Theatre Royal which, despite the best efforts of Ian McKellen and Patrick Stewart – both of whom I like very much – to this day remains one of the dreariest experiences of my life.

It is on that note that we welcome 2021, with all the promise it holds, and return to our ‘top picks’ for 2020, a year which is probably best summarised (for those of us lucky enough to have been not directly impacted by the virus) by the Lord Chamberlain’s censor in his review of the first performance of Godot in 1955 – in which he described having to ‘endure hours [and hours] of angry boredom’.

As always, these ‘picks’ do not represent advice, and should in no way be relied upon as such; they have been chosen on a light-hearted basis with no thought given to their suitability for your personal circumstances.

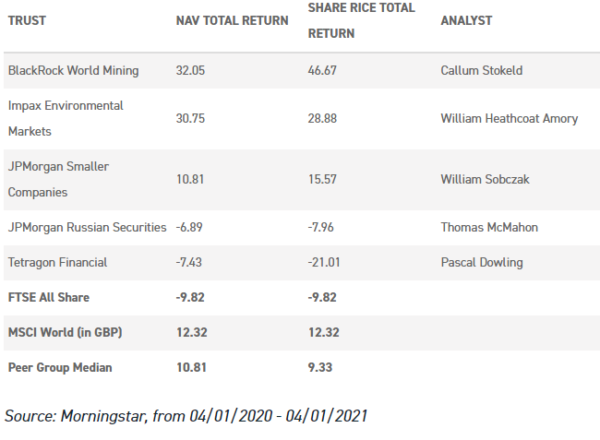

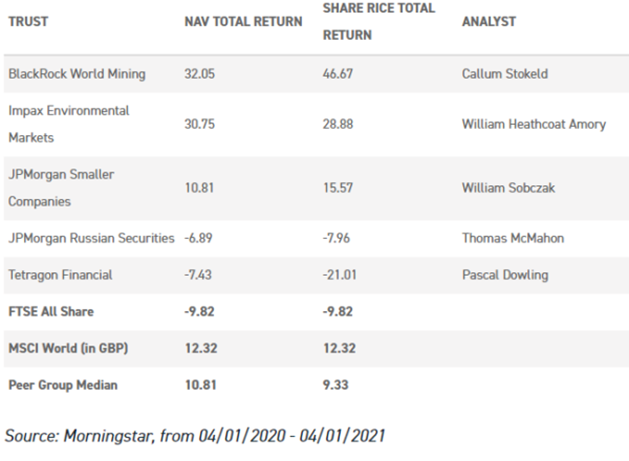

How did last year’s picks perform?

Our picks for 2021

Pascal Dowling

My confident choice for the win at the start of 2020 was Tetragon Financial Group (TFG); a diversified portfolio of alternative assets including bank loans, real estate, convertible bonds and event-driven equities via hedge funds.

At the time, when the trust was trading on a discount of 47%, I said: “At such a wide discount, with such solid returns and a decent income to boot, surely there’s plenty of room for that to come in once investors cotton on.”

Since then, Tetragon Financial Group has lost 7% in NAV terms, the discount has widened out to 60%. To cap it all, in December one of the largest holdings – Ripple Labs – has been accused of misleading investors by the Securities and Exchange Commission.

Not a resounding victory. In fact I am the worst performer on the investment research team. I once bought shares in HMV because I thought digital music was ‘never going to take off’, so this is not a feeling I’m totally unfamiliar with.

Past performance is not a guide to future returns, however, and so undeterred by this setback it is with great conviction that I choose Invesco Perpetual UK Smaller Companies (IPU) as my top performer for 2021.

It is perhaps with some degree of cognitive bias that I believe the UK is in better shape than it is perceived to be. The never-ending drudgery that was Brexit has finally reached its conclusion, the sky has not fallen in despite the endless predictions that it would, and the UK has apparently got off to a good start on the vaccine front despite the same kind of miserable journalism that has somehow turned the development of a vaccine in less than twelve months into a mere addendum to the bad news that it will be a challenge to get it into 60 million people’s arms.

More than half a million people had been vaccinated in the UK by Christmas eve and, as I write, the logistical effort to expand the programme – a combined effort on the part of the NHS and the armed forces, from what I can make out – is well underway with more than 1,000 vaccination sites already set up and ready to go.

A further half a million doses were ready to go on Monday this week while on the other side of the channel, the French – who I mention only by way of example (and it seems fitting to do so given that Perfidious Albion got a mention in Macron’s New Year’s message) – have managed to vaccinate 350 people.

The UK has been at the bottom of the heap for investors for a long time, and the true impact of the Coronavirus in economic terms is yet to be felt here as elsewhere, but we are in my view in a better position than most to move forward once the vaccine becomes widespread, with the vast, insoluble uncertainty that was the Brexit deal (or no deal) no longer holding its foot on the neck of our fortunes.

Against that backdrop, in our view, IPU’s discount (c. 8%) could be a significant attraction for investors, having been savaged in 2020 after a long period of trading at a premium to its peers. While that discount has come in somewhat recently, we believe that the fundamental factors behind the historic premium rating versus peers have not changed.

The trust continues to offer a relatively secure dividend stream (albeit lower than the previous trajectory) which offers a significant yield premium to peers. Certainly, the short-term performance since the market nadir has not matched some ‘growthier’ peers.

However, investors mustn’t forget that this is likely a characteristic of the careful, risk-averse investment process which, in our view, has enabled the managers to deliver on their objective of top quartile performance but with below-average volatility over the long term.

William Heathcoat Amory

In choosing Impax Environmental Markets (IEM) last year, my thesis was that there would be ever more focus from investors on climate change. I wasn’t to know that Larry Fink (CEO of BlackRock, the world’s largest asset manager) would a few days after the new year publish his Dear CEO annual letter highlighting that climate change was a key area of focus for the company.

He stated that “Climate risk has become financial risk,” and explained that “because capital markets pull future risk forward, we will see changes in capital allocation more quickly than we see changes to the climate itself. In the near future – sooner than most anticipate – there will be a significant reallocation of capital”.

IEM’s portfolio is very significantly exposed to the themes that Larry Fink has observed. It owns mid- and small-cap companies around the globe that offer solutions to environmental challenges within four main areas: clean energy and energy efficiency, water treatment and pollution control, waste technology and natural resource management, and sustainable food. IEM has performed well, all things considered.

The NAV underperformed the MSCI ACWI during February and March, largely due to its small- and mid-cap exposure, but also due to cyclical exposures and being underweight healthcare and the US dollar.

Nevertheless, lessons learned from managing the trust over the past 18 years enabled the team to hold their nerve, a result of which IEM rebounded more strongly.

Increased interest in the companies that IEM owns from generalist investors, combined with strong earnings growth, means 2020 has been a hallmark year for IEM with the NAV outperforming the benchmark by c. 17% over the calendar year.

Part of the reason I picked IEM was the board’s commitment to protect the shares from slipping to a wide discount. 2020 has seen pressures of the opposite kind being applied, with the company being a significant issuer of shares.

This is positive for investors given the tiered fee structure should mean that the OCF will continue to edge down, as further shares are issued. That said, the board have limited capacity to issue an unlimited number of shares, and so the premium to NAV has at times been close to 10%.

As it happens, IEM finished the year on a premium of 2.3%, meaning share price returns have very slightly lagged NAV returns, illustrating the risks of investing at chunky premiums.

Growth trusts have been in favour this year, and so for investors who look to buy trusts on discounts, there are relatively slim pickings at Christmas time this year!

However, in my view Oakley Capital Investments (OCI) could fit the bill and is my pick for 2021. OCI is a listed private equity trust that has a highly concentrated portfolio exposed to the sectors that manager Oakley Capital focuses on, being technology, education and consumer.

The last time OCI reported on its underlying investments (in September, regarding the results to 30 June), the team stated that 12 out of their 15 companies are forecast to meet or beat their budget for 2020, or have returned to budgeted run rates in H2.

In our view, this gives reassurance that the majority of the portfolio should prove resilient through 2020. Indeed, some of the companies are likely to have been strong beneficiaries, but time will tell.

OCI trades on a discount to NAV of 19% currently, but this is to valuations provided at the end of June. Equity markets have moved on considerably from here (many up by mid-teen percentages), and peers in the LPE sector have also reported strong valuation gains and realisation activity since June.

This gives us confidence that the real discount is likely to be wider than 19%. We believe that OCI’s historic performance, its narrow sector focus in areas which have proved resilient to COVID-19, and its significant cash balances giving it plenty of room for manoeuvre, mean that it should deserve a significantly narrower discount.

The upcoming NAV announcement at the end of January (30 December valuations) should give more colour on how the portfolio has performed over the second half of 2020, and could be a catalyst towards a re-rating.

Thomas McMahon

Last January risk appetite was picking up in the world and the markets seemed optimistic about 2020. JPMorgan Russian Securities (JRS) looked like a way to get exposure to a country that had been left behind and could have catch-up potential. The state was flush with cash and planning infrastructure spend, while the P/E on the market looked extremely low.

High dividends and improving corporate governance looked set to see foreign interest rise. It is fair to say I would not have picked such a cyclically-exposed strategy had I seen the pandemic coming! A collapse in global demand for oil was kryptonite for the Russian market, which has been one of the worst performers during the crisis.

Risk appetite has been picking up in the world and the market seems optimistic about 2021. I am going to follow Nick Train’s advice and be biased towards optimism. In my view Henderson Opportunities Trust (HOT) could do very well this year. It is a significantly geared portfolio of UK stocks biased to the mid- and small-cap space.

James Henderson and Laura Foll have built a portfolio balanced between COVID winners and COVID losers, with value and growth exposure. Historically it has done extremely well in cyclical UK recoveries, and its discount has remained wider than many of its peers, meaning there is good potential for the share price to catch up next year in my view.

At the time of writing, the discount is c. 10%, having come in from 15% before the Brexit deal was reached. There has been a Brexit bump already, and I worry about the next couple of months as we head back into lockdown.

However, once the vaccine is rolled out, I expect the UK to do well and HOT is well placed to benefit. Let’s hope fate rewards optimism more this year.

Callum Stokeld

Maybe less so for the world, but 2020 was a good year for BlackRock World Mining (BRWM). After a challenging Q1 2020, a broad-based commodity rally has fed through to operational performance of the underlying companies.

With different components, between industrial and precious metals, taking the reins at different aspects, this has re-emphasised the attractions of the diversified commodity approach taken by BRWM (bear in mind, gold miners have been in a correction/consolidation phase since not long after the start of Q3 2020; diversified and industrial metals miners have taken up much of the slack).

With global money supplies rocketing, amidst a combination of US swap lines to overseas central banks and soaring central bank balance sheets across the globe, in conjunction with extensive fiscal support for beleaguered economies, it is unsurprising that commodity prices rose relative to fiat currencies across the globe.

This is particularly so given the supply discipline that has been exercised by the major mining companies, in particular. The outlook, in this analyst’s view, remains positive; I would posit we are in a multi-year bull market for commodities with attendant benefits for the mining companies.

Perhaps the market agrees, with a tailwind of discount narrowing over the calendar year 2020. Or perhaps investors simply recognise that major miners are likely to remain free cash flow positive and dividend generative even on notably lower spot commodity prices?

A confluence of bull factors remains in play, though sustained, multi-year bull markets will entail substantial pullbacks intermittently.

Looking ahead to 2021, speculative positioning across a range of assets is extremely high, and margin debt has risen incredibly rapidly in the US.

Aligned with market structures and with Robinhood facing potential investigation for offering inappropriate options contracts to retail investors, trusts which typically display positive sensitivity to rising volatility, such as Ruffer Investment Company (RICA) and BH Macro (BHMG), thus seem compelling.

Similarly, agricultural inflationary pressures are gathering steam, which is a headwind for China, where foreign investors must surely be reassessing their holdings following the effective curtailment of Ant Financials growth (I ‘hate’ to say “I told you so”).

This, attractive relative and absolute valuations, the most rapid regional earnings growth forecast in the world, and macro tailwinds make BlackRock Latin America (BRLA) a compelling opportunity in the GEM space in my view.

However, I am sticking with a more direct commodity play and going for Golden Prospect Precious Metals (GPM). My starting point is that we entered a multi-year bull market for commodities in late 2015. This has been challenged, but now we are motoring.

Fiscal repression is coming; akin to what we saw in the 1940s, the Fed will hold bond yields at (increasingly) negative inflation-adjusted levels. This provides a strong boost to gold spot prices, which tend to correlate with a strong inversion to real yields.

Yet silver looks even more attractive on a relative basis. The silver to gold ratio suggests support to silver is cheap relative to gold, and yet that momentum has started to reverse past critical levels. ‘Green’ infrastructure spend will require vast amounts of silver, and Goldman Sachs and Citi have both published very bullish estimates on the silver spot price (the former targeting a $50 level, from the current level of c. $26). S&P exploration reports, as well as more anecdotal evidence, continue to suggest supply discipline in exploration budgets.

Free cash flows are positive, with gold and silver mining companies at an index level having reduced debt through this strong positive free cash flow, whilst selling forward at current prices relatively little future production (leaving positive sensitivity to future price rises).

Yet the renewed bout of lockdowns threatens near-term industrial activity. For this, and the reasons above, I have preferred to pivot away towards more junior mining companies and towards precious metals (in particular silver), and slightly away from the longer-term bullish thesis I pushed on BRWM in 2020 to a more specialised play.

BRWM remains, in my view, highly compelling over the longer term, and offers a more diversified and more liquid way to take exposure to the commodity markets than GPM. Yet copper (a key bell-weather) looks a bit overdone in the short-term, to me at least.

I would caution that I expect significant drawdowns on this commodity bull market journey. In 2021, I would be surprised if GPM did not experience a 20-30% drawdown, and a 50% drawdown wouldn’t shock me.

However, looking at underlying gold and silver miners, the convexity to rising spot prices is supremely compelling to me.

William Sobczak

2020 has been another strong year for JPMorgan Smaller Companies Trust (JMI). Over the year the trust saw NAV total returns of 10.7%. This compares to a return of 4.9% from the benchmark and 1.6% from the peer group, according to Morningstar. As such, the discount narrowed from double digits to a premium of c. 4%, further enhancing returns for investors.

The majority of the strong performance has come from the managers excellent stock selection, including the likes of Team17, Avon Rubber and Games Workshop, each of which has doubled in 2020.

However, the positive outcome of a Brexit deal also buoyed returns towards the end of the year, and I believe this has the potential to continue doing so in 2021.

My stock pick for 2021 is Miton UK MicroCap Trust (MINI). Launched in 2015 and managed by small caps veteran Gervais Williams, who has published a number of books on the sector, it invests predominantly in a portfolio of smaller UK companies, typically with a market capitalisation below £150m.

The trust has been the strongest performer in the AIC UK Smaller Companies sector over the past one month, six months and one year. Despite this, the trust trades on a 13.1% discount, relative to a sector average of 2.8%.

I believe that there is plenty of room for the trust to run in 2021, given the underperformance of the UK equity market since the Brexit vote in 2016.

The resolution of this is likely to be a significant rebound of the UK economy, particularly in the small-cap area, allowing the trust to fully participate both in terms of NAV and the narrowing of the discount.

David Johnson

I joined the team in Q4 last year, so have the benefit of a completely clean track record, and with that behind me my choice for 2021 is Scottish Mortgage Trust (SMT) even though they say lightning never strikes twice, tell that to Roy Sullivan (he’s been hit 12 times).

SMT had a stellar year in 2020 with a NAV return of 108% (Source: AIC). While past performance doesn’t guide future results, this analyst still sees strong tailwinds supporting this growth-stock champion.

In my opinion the biggest factor underpinning the expensive valuations for many of SMT’s holdings is the rock bottom yields bonds offer currently, which reduces the opportunity cost for holding equities.

Despite the potential for an eventual vaccine-based solution to COVID-19 and the loosening of fiscal belts, I see little chance for a 2021 economic recovery sufficient to push yields higher, especially given the ongoing need for lockdowns with the continuing rise of COVID-19 cases.

There are also few headwinds to derail the prospects of SMT’s underlying holdings, the majority of which are technology names. While COVID-19 has led to a huge surge in demand for many of their services, I do not believe it will simply dissipate with its eventual resolution.

Rather, COVID-19 has stabilised many companies’ earnings over the long term as people become hesitant to give up the benefits of the new work-from-home lifestyle.

Even TESLA, SMT’s largest and possibly most optimistic holding, only missed its half a million vehicle production target by 50 cars, surpassing analyst expectations in the process.

Click to visit:

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Click to visit:

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.