A green kick-start?

Increased spending world-wide as governments seek to kick-start economic growth may have added benefits – boosting sustainable projects. Could responsible investment solutions provide the necessary tonic for beleaguered policymakers and investors to change the face of both the global economy and society itself? Here, managers from across BNY Mellon Investment Management consider the likely road ahead.

While signs of a fragile normality return to global markets, the seismic economic ructions triggered by the 2020 Covid-19 pandemic continue to reverberate across global governments and businesses. The initial shock which followed its emergence and the longer-term reaction to it have raised many questions about the world’s economic and social priorities and the way we, live work and plan for the future.

This crisis has also come at a time when global trade relations have been – and continue to be – unusually sour. Among these have been increased Sino-US trade tensions, while Brexit has created new divisions between the UK and European Union (EU). This has created questions over the future shape and viability of some longstanding supply chains and global trade connectivity.

Commenting on the growing focus on business and social links and business practices, Mellon senior portfolio manager Robin Wehbé says: “Recent events have really opened all our eyes to the social connections and inter-exchanges between the complex web of stakeholders in business and wider society. Where mega storms once woke us up to climate change, so a global pandemic has hopefully woken us up to more humanitarian challenges.

Investors and other stakeholders are asking more questions about employment stability, pay equality and labour risks. How should companies manage an office full of people, a shop or a factory? Not only that, how do we now contemplate supply and distribution value chains?”

Some see the current time as an ideal opportunity to take stock and work to refashion our economies to make them both more sustainable and resilient. And if no further reason was needed, the growing climate emergency is one huge indicator for which this might make sense.

Newton’s head of sustainable investment Andrew Parry says: “Is the business world about to tilt on its axis? A lot of people say the world will never be the same again, whereas others might think that could be wishful thinking because we may be seeing an acceleration of certain trends rather than a reversal of broader trends.”

Either way, the sheer volume of government funding spent to head-off global economic collapse amid the pandemic has been stark. In July European Union (EU) leaders struck a post-coronavirus recovery deal worth €750bn in grants and loans¹. Earlier in the year the US Senate also approved a US$2trm emergency relief bill to address fallout from the pandemic.

Against this backdrop of spending, Parry sees a genuine opportunity to rethink our approach to sustainability and responsible investment across all three environment, social and governance (ESG) spheres. “Now may be the time for companies to rebalance expectations away from maximising short-term returns – the use of excessive debt and extended supply chains to reduce labour costs – towards the quality of those returns. In short, we have an opportunity to re-examine notions of efficiency in favour of resiliency ,” he says.

Much, Parry adds, will depend on our ability to learn from what he sees as critical mistakes made after the Global Financial Crisis (GFC) when a reliance solely on market forces and cheap borrowing led to a compounding of challenges. This, he believes, resulted in a failure to deliver a more inclusive economic recovery, one that recognised the long-term benefits of tackling pressing social and environmental issues.

While the arrival of quantitative easing in 2008 led to an economic recovery, it was a missed opportunity for governments to place incentives in the systems to encourage a flow of capital to areas of need rather than merely to bolster corporate profits – often at the expense of social and environmental challenges,”

Parry believes today there are better financial economic models we can learn from. He points to the adoption of new thinking in the Dutch city of Amsterdam, drawing on so-called ‘doughnut’ economics. This is a framework created by the Oxford economist, Kate Raworth.

Amsterdam has officially embraced a sustainable development model as a way of emerging with purpose from the Covid-19 crisis to balance needs without harming the environment. A central part of Raworth’s economic model is the inclusion of the UN Sustainable Development Goals for 2030 (SDGs).

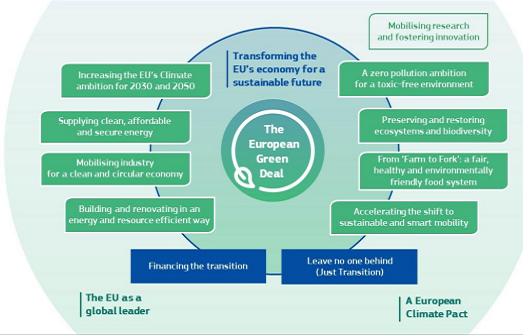

Elsewhere, Parry points to the European Union’s (EU) latest green initiatives, including its much touted Green Recovery Plan, as positive news for responsible investment within continental Europe.

Key elements of the European Commission European Green Deal

Source: European Commission December 2019.

At a global level, the UN estimates that the successful delivery of its Sustainable Development Goals (SDGs) could ultimately add US$12 trillion to the global economy, alongside 380 million new jobs.

Yet Parry is concerned, that, at this level, there is still not enough progress being made to hit the UN’s targets on climate change and other sustainability goals.

“In reality the flow of capital and tangible action needed to deliver on the United Nations’ (UN) Sustainable Development Goals (SDGs) have fallen well below target. The latest report from the World Business Council for Sustainable Development reveals that while 84% of member companies referenced specific goals in their sustainability reports, only 15% had aligned their business strategy to specific target-level SDG criteria.

“The danger in this is that SDGs become used as a communicative tool rather than as a broader framework to support capital-allocation decisions. It also seems some companies rarely get beyond the headline goal in the relevant SDG – creating the potential for ‘SDG washing.’ Clearly, more urgent action is needed in this area over the next decade as we recover from the Covid-19 crisis with genuine partnership likely to be a key element of SDG’s success.” he says.

Beyond the work of the UN and wider public sector initiatives, Insight senior ESG analyst Joshua Kendall believes the private sector can also play a major role in driving sustainability initiatives.

“The transition to a new green economy will be expensive for countries. I see Europe as a driver of change. But public money is not the only driver, companies are also investing in technology to reduce emissions. Sure, there are costs involved, but when you see where the money is coming from, I see clear support from major investors in the shift to a greener economy,” he says.

Although Covid-19 has proved an enormous global distraction, many minds are still clearly focused on sustainability and the overarching threat of climate change. While the important Cop26 intergovernmental climate talks have been postponed until 2021 investors are increasingly taking action into their own hands.

In August, the UK’s biggest pension fund – the government backed National Employment Savings Trust (NEST) announced it was divesting from fossil fuels. The fund, which serves nine million members is to ban investments in companies involved in coal mining, tar sands or arctic drilling and has said it will shift £5.5bn to more environmentally friendly assets.² The fund joins a growing number of pension schemes and other institutions divesting from fossil fuels and related industries.

Although historically questions have been raised over the potential for a drag on investment returns from responsible investments, recent research suggests the reverse might be true. Data provider Morningstar examined the long term performance of a sample of Europe-based sustainable funds and found the majority of strategies had done better than non-ESG strategies over one, three, five and 10 years.³

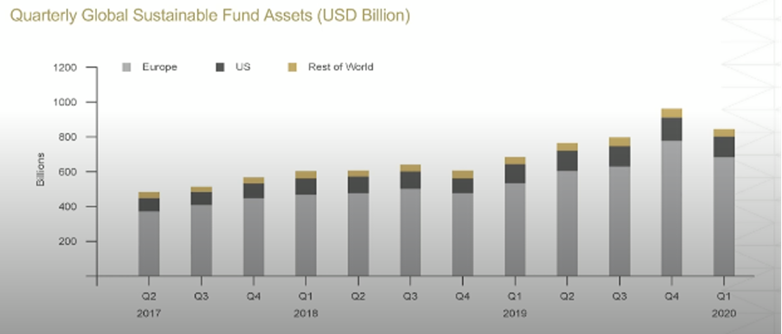

This may partly explain why, despite the recent downturn, sustainable and ESG funds continue to attract a growing number of investors, with US ESG funds drawing a record US$10.5bn of new investment in the first quarter of 2020 alone.⁴

Source: Morningstar research data as of 30 March 2020

While much of this growth has come in equity markets, sustainable investment is also increasingly taking centre stage across global fixed income markets.

In Europe, recent growth in this area has seen a particularly strong focus on social bonds, designed to deliver positive social impacts. The market grew by an estimated 43%to €66bn in the three months to 30 June 2020.⁵

While much of this growth came as agencies and supranational issuers sought to ease the economic and social impacts of the pandemic, other areas of ESG fixed income investing also see healthy growth. Issuance of impact bonds alone surged to US$300bn last year⁶ and interest in ESG across other areas of fixed income investment continues to grow steadily.

While ESG rises rapidly up the investment agenda, Newton portfolio manager Scott Freedman says he believes the Covid-19 pandemic and its aftermath will leave a lasting legacy for global markets and could strengthen the need to adopt a fairer, more sustainable investment approach.

“The crisis has made social and economic concerns much more pressing than they were before the pandemic and has actually really kick started some of the more recent ‘green’ initiatives and perspectives we are seeing today.

“Going forward, companies will likely face great scrutiny on how they dealt with the pandemic at its height but also whether they can sustain appropriate performance while supporting a broad range of stakeholders in what could prove to be a long, slow recovery,” he concludes.

Many companies once sceptical of ESG and wider responsible investment initiatives have already had to take notice of growing shareholder scrutiny and public interest in corporate reputations.

As some corporations have found to their cost, avoiding environmental, social and governance best practise can result in serious reputational damage.

Indeed peak-to-trough market capitalisation losses of over US$534bn were reported for large US companies as a result of major ESG related controversies over the past six years.⁷

Looking ahead Parry believes a revolution in ESG standards could ultimately bring some major benefits for companies, their shareholders and the wider world and remains hopeful recent events could lead to a sea change in practice.

“In the final analysis, the reality is that a better society is actually good for business. Living in a healthy environment rather than a dystopian wilderness is better for sustaining profits and life on the planet and can help stem the systemic risk of climate change,” he concludes.

Click to visit:

¹BBC. Coronavirus: EU leaders reach recovery deal after marathon summit. 21 July 2020.

²Observer. Largest UK pension fund goes green. 02 August 2020.

³FT. Majority of ESG funds outperform wider market over 10 years. 13 June 2020.

⁴Morningstar.Global sustainable fund flows. ESG funds show resilience during COVID-19 sell-off. May 2020.

⁵Institutional asset manager. Social bond and sovereign green bond issuance surges. 30 June 2020.

⁶Worth.com. How to Keep Impact Investing Impactful. 27 July 2020.

⁷FT. ESG controversies wipe $500bn off value of US companies. 14 December 2019.

Important information:

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.