In adversity, strength: NB private equity partners

Disclosure – Non-Independent Marketing Communication. This is a non-independent marketing communication commissioned by NB Private Equity Partners. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

In this article we look at a number of catalysts that could see NBPE’s discount narrow, potentially offering a ‘double whammy’ in terms of returns for investors…

The uncertainty and volatility caused by COVID-19 has presented a number of opportunities within the investment trust world, as discounts widen to ten year records.

The investment trust structure is particularly suited for private equity investing, as it is with other illiquid investments, due to the fixed pool of assets which protects the manager from the need to meet redemptions.

In this article we look at NBPE, a unique investment trust which – given the right conditions – has the potential to see its discount narrow, whilst offering the potential for capital growth and income for investors regardless of the wider market conditions.

A unique approach…

NB Private Equity Partners (NBPE) is a London-listed private equity investment company.

As we discuss in our recent research note, the team employ a unique approach to investment – investing through direct equity co-investments. This is a method by which private equity sponsors (or managers) buying a private company invite other investors into the deal.

Dramatic downward market movements, such as those seen in Q1 2020, tend to disproportionately impact investment trusts, in particular those with lower trading volumes.

Often these are amongst the most specialist vehicles, where complexity is a deterrent to many investors. When typical trading volumes are thin, even mild selling pressures can cause market makers, without a reliable buying counterparty to match with, to disproportionately mark down prices to try and match buying and selling volumes.

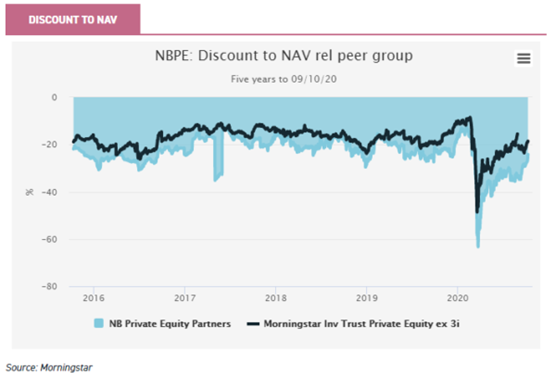

As can be seen below, the initial market correction due to COVID -19 had a significant impact on NBPE’s share price, along with its peers.

Subsequently, private equity and public equity markets have rebounded from the lows, with the change over the entire year less significant than seemed likely at the time. That said, discounts across the LPE sector still haven’t recovered to where they were at the start of 2020.

Given the divergence between the trust’s discount and peers, now could be an interesting entry point into the trust, and while risks continue to exist, there are a number of potential catalysts for the discount to narrow.

The first potential catalyst is a change in the perception of the gearing level and what it means for the trust.

The trust’s methodology of investing through direct co-investments, unlike other private equity trusts, means that new investment decisions are made in ‘real-time’ and without the need to commit capital far into the future.

As a result, the managers have better control of their rate of investment and consequently, their balance sheet. Other private equity trusts, who may on the face of it appear to be less geared, could actually be more geared because of their long-term commitment liabilities.

Secondly, realisation activity should bring down the gearing level and allow the board more room to contemplate buybacks. Previously the board were open to buybacks when the trust was trading at a significant discount to NAV, however this facility was switched off in March of 2020 to conserve cash. Once a level of normality is restored, we will likely see this return which could further narrow the discount.

Thirdly, there is evidence that companies in the portfolio have proved more resilient in operating terms than public market indices.

Most private equity backed companies and funds are only valued periodically, so share price falls of listed trusts were based on an expectation, rather than evidence, of expected NAV declines.

Should the reality of the NAV performance exceed expectations, we could see renewed buyer interest which could help the discount to narrow over time.

A recent update supported this, with the manager’s late cycle positioning in resilient sectors such as technology, healthcare and certain consumer sectors, reducing the impact of COVID 19 on the portfolio.

The next net asset valuation will be in Q4 of 2020, and we believe will likely further show the resilience of the portfolio.

The final potential catalyst is any news of realisations. This is a critical component of short term NAV growth, given that NBPE has experienced an average of c. 23% uplift to valuations (nine months prior) from IPOs (at the closing share price) and exits since 2017, based on data from the manager as of 31 August 2020.

Despite the adverse circumstances of 2020, the manager reports that realisation activity in the world of private equity has been relatively strong.

As evidence, we observe that in the calendar year to 30 September 2020, 11% of the portfolio has been realised – a similar run rate to 2019.

If private equity sponsors are able to take advantage of the current market environment to realise assets, this should further support NAV growth and provide cash to reduce gearing and perhaps enable buybacks.

NBPE is a clearly differentiated trust within its sector. While investors should be cognisant of the risks associated with any complex investment, if we see the leverage reduce and if performance continues to be resilient, the trust’s attractions may well be reflected in a narrower discount. Any buybacks that the board complete could also be accretive in NAV terms to shareholders.

Find out why now could be an exciting time to invest in NBPE’s unique offering…

To buy this trust login to your EQi account

Select NB Private Equity Partners GG00B1ZBD492

Disclaimer

This report has been issued by Kepler Partners LLP. The analyst who has prepared this report is aware that Kepler Partners LLP has a relationship with the company covered in this report and/or a conflict of interest which may impair the objectivity of the research.

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that if you are a private investor independent financial advice should be taken before making any investment or financial decision.

Kepler Partners is not authorised to market products or make recommendations to retail clients. This report has been issued by Kepler Partners LLP, is based on factual information only, is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.