Lifetime ISA: Fast facts

What does LISA stand for?

The Lifetime ISA.

What’s the big appeal?

The government will add a 25% bonus to what you invest, up to £1,000 a year on your maximum £4,000 investable allowance until you are 50.

Can anyone open a LISA?

No, you must be aged 18–39.

But if you have generous benefactors in your life, they can contribute to your LISA (cough – calling all affluent and benevolent parents and grandparents).

What’s the difference between a cash LISA and a stocks & shares LISA?

With a cash LISA, you save your money rather than invest it. Money in a savings account is safe but with interest rates low, you may not enjoy great returns.

If you have time on your side, investing in stocks and shares could see your money perform better than cash. Although past performance is no guarantee of future performance, UK stocks and shares have returned an average of 4.9% in real terms since 1899, compared to just 0.7% for cash. *

Let’s say you have 10 years to save or invest and you deposit £4,000 in year one, which HMRC tops up by £1,000. With £5,000 saved, you could expect your pot to be worth £5,362.43 by year 10. If you did the same but through a stocks and shares LISA, based on past average, it could amount to £8,153.44.

There are risks to investing, but also potential for greater rewards than cash saving.

What investments can I put in a LISA?

You can access over 8,000 investments on the EQi platform, from individual companies to funds, which means you invest in a whole basket of shares in a single investment. Many customers choose to invest in Funds as by investing in lots of assets, rather than one company, you can balance risk.

For example, if you invest in one company, the value of your shares is locked in with the performance of that company, with a Fund, the aim is that even if some assets underperform, others will create better returns and so even out overall performance.

What about the drawbacks?

Your LISA must be used either to buy your first home (under the value of £450,000), otherwise you can access it penalty-free from age 60.

Can I combine a LISA with other ISAs?

You can invest in a LISA and use the rest of your annual tax-free ISA allowance of £20,000 per year.

Why do LISA fees matter?

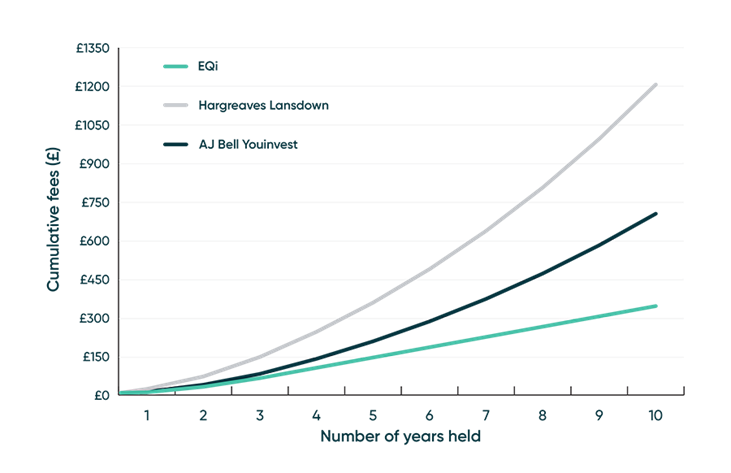

Like interest rates, fees compound over time. So, the lower your fee, the more your money is put to work through your investments. Here’s how the difference in fees can mount up.

Graph accurate as of April 2021. Model based on a 50/50 split between shares and funds with a growth rate of 4% p.a.