Building a really simple investment portfolio

For those new to investing, the sheer choice of investment options can be daunting, but it should be possible to construct a simple, well diversified investment portfolio without having to research individual stocks; by using just two tracker funds you can keep costs and maintenance to a minimum – writes Christian Leeming.

However experienced or sophisticated an investor, there are basic principles that apply and one of the most important is to determine how much risk you can tolerate; viewed historically, riskier investments such as stocks and shares show better potential for long-term growth, but can suffer greater losses at times of the market volatility we have experienced since Covid-19 struck.

Investments that are traditionally used to preserve capital such as government bonds (gilts) or highly-rated corporate bonds deliver greater protection during market volatility because they deliver fixed levels of income, but over the long-term they are less likely to deliver strong growth.

The objective when building a portfolio is to achieve a balance between investments that can deliver the returns you require in pursuit of your goals – without it feeling as though your hair’s on fire – coupled with investments that can protect your money when things look dicey; a balanced portfolio blends capital preservation with growth, and most investors with a moderate risk tolerance can achieve that with just two Exchange Traded Funds – ETFs.

ETFs are ‘passive investments’ or tracker funds that seek to return the performance of a chosen index or basket of investments, whilst keeping costs low – more here.

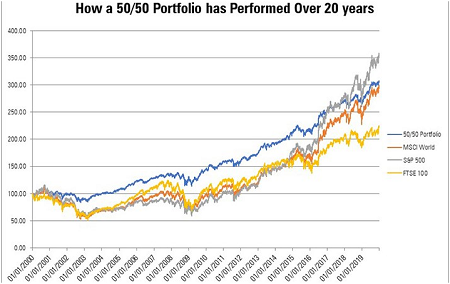

Creating a balance between capital preservation and long-term growth potential can be achieved by marrying an ETF that invests in shares with one that invests in bonds; a very simple portfolio split between two global stock and bond ETFs, 50/50, has delivered higher returns than key equity market indices such as MSCI World or FTSE 100 over the past two decades.

Sometimes rather dismissively described as the ‘couch potato’ portfolio a 50/50 allocation may not deliver the harem scarum adrenaline rush of stock picking, but how many looking to build long term wealth seek such a thrill?

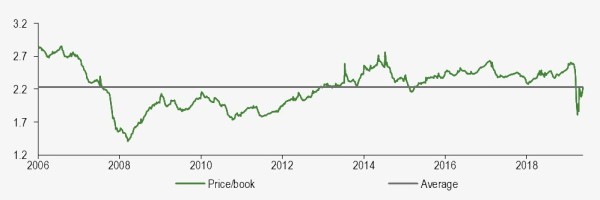

This chart shows that even the S&P 500’ bull run since 2009 only just pipped the performance of the 50/50; the latter displayed the real benefit of diversification by protecting the downside in the face of the dotcom crash and the 2008 financial crisis.

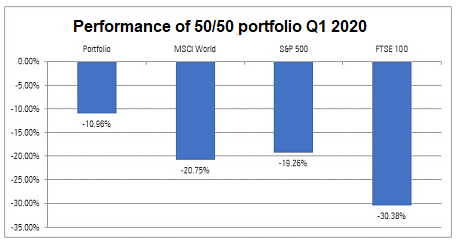

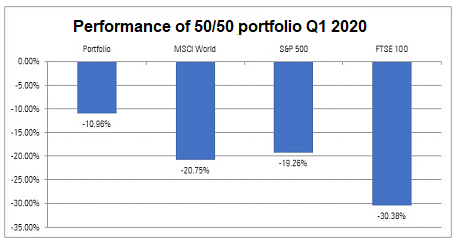

More recently, Covid-19 saw the FTSE 100 deliver its worst quarterly performance since 1987, with the index giving up 35% at one stage; by contrast, and notwithstanding the jitters felt in international bond markets, the 50/50 portfolio’s ability to shelter capital limited its fall to just 10% as shown below:

Select an Equity ETF

For the equity allocation, investors may consider an ETF that tracks MSCI World, an international equity index, which includes stocks from 23 developed countries.

With 1,640 constituents (as of 30/04/20), the index covers approximately 85% of the free float-adjusted market capitalisation in each country.

Options include the iShares Core MSCI World UCITS ETF (SWDA) or the SPDR MSCI World UCITS (SWLD) which are broad and diversified ETFs that cover nearly every developed country stock.

The funds are balanced across territories and sectors and have competitive ongoing charges of just 0.2% and 0.12% respectively.

Geographically, the US accounts for 65.64% of the MSCI World index value, followed by Japan (8.11%), the UK (4.67%); by sector the most significant are information technology (19.57%), healthcare (14.67%)and financial services (13.02%) industrials (10%).

Portfolio concentration is limited, with the top 10 holdings accounting for around 15% of the total value of the index.

Select a Bond ETF

For bond exposure investors could track the Bloomberg Barclays Aggregate Bond Index or the ‘Agg’ which is a broad based capitalisation-weighted index often used to measure the performance of the US bond market.

Choices include the Vanguard Global Aggregate Bond UCITS ETF (VAGS) or iShares Core Global Aggregate Bond UCITS ETF (AGBP); each has an ongoing charge of 0.10%.

Holdings are diversified in terms of type and geography and include investment-grade government bonds (55-60%) government-sponsored agencies (10-15%), corporate and securitised bonds, such as mortgage-backed securities and local authority bonds from a large number of developed and emerging economies.

US issuers accounts for around 40% of the index, with a large presence of US Treasuries; Japan follows with just over 15% and France, Germany and the UK account around 5% each. Emerging market issuers total 10% of the index.

Maintain your portfolio

Rebalancing the portfolio in order to keep the targeted 50/50 allocation is important because it helps to control risk – more here.

This means selling investments from the ETF that has outperformed and reinvesting the proceeds into the ETF that has underperformed; in periods of strong market performance the weight of the equity ETF will typically grow larger, while in times of crisis its value will drop.

Failing to rebalance can result in increased risk if the equity allocation’s weight grows, or limited returns if the weight of the bond allocation goes too high.

However, one of the key attractions of ETFs is their low price, and rebalancing too frequently can wipe out that advantage with high trading costs; a 10% buffer should suffice for most investors – once the weight of the one of the ETFs gets to 60% of assets, they should be brought back to an equal weight.

This simple balanced portfolio could be perfect for an inexperienced investor looking for an uncomplicated way of investing for the long-term; ETFs make excellent building blocks as they deliver an instantly diversified portfolio at low cost.

With just two ETFs it is possible to achieve exposure to most of the investable global stock and bond markets, diversified in terms or geography and sector.

Tell us your experience of a 50/50 portfolio – which ETFs or other vehicles you chose, and how they performed during the recent market dive – ask@diyinvestor.net

EQi's fund lists

Use our fund lists to find funds based on insight and ratings from Square Mile, one of the largest and most respected investment research teams in the UK. Our lists are a great way to narrow down your choice before you select which fund best suits your investment goals.

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.