Value matters eventually

Financials remains one of the cheapest equity market sectors; they jumped sharply in price following the positive news around vaccines in November, as the sector is one of the biggest beneficiaries of economies opening up over the course of this year and into 2022 - Polar Capital Global Financials Team.

Their earnings are sensitive to economic activity; therefore the improving outlook has driven the rally as confidence in the earnings outlook for the sector over the next couple of years has risen sharply. This should not be a surprise.

At this point of the cycle the sector has discounted a much worse downturn than has actually happened, thanks to government and central bank actions to reduce the economic impact of lockdowns and changes in spending patterns.

Looking back over previous recessions or market falls, having discounted the bad news financials have always outperformed almost immediately, whether it was the failure of LTCM in 1998, the TMT bubble in 2000, Iraq war in 2003, the global financial crisis, the Eurozone crisis or the UK referendum in 2016. This time is no different and history suggests there is much further to go.

Earnings for the sector are forecast to be up 38.9% in 2021 and 10% in 2022, led by the recovery in the earnings of bank shares as new accounting rules have forced banks to make loan loss provisions much earlier in the cycle than previous downturns.

As a result, these provisions were set when the outlook in the middle of 2020 was much cloudier and will prove to be too conservative. For example, under its base case forecast JP Morgan has stated it has excess provisions of $10bn.

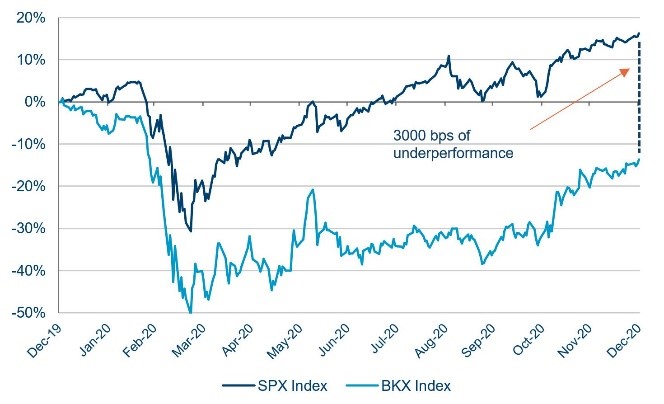

In fact, the surprise of this downturn was that last year banks’ shares, as illustrated by the chart below, underperformed by more than they did in the global financial crisis, when banks were failing, and confidence in the financial system collapsed. Today it is very different. Bank balance sheets are strong and they have been part of the solution, providing a conduit for government-guaranteed lending to support businesses and allowing many individuals and businesses to take payment holidays.

S&P500 vs KBW Bank Index in 2008/2009*

S&P500 vs KBW Bank Index in 20201*

Source: *Bloomberg, 31 December 2020

Furthermore, regulators are likely to remove all remaining restrictions on banks paying dividends and buybacks at some point during the year. US and Asian regulators took a pragmatic approach, unlike their European and UK counterparts, in allowing banks to continue to pay dividends last year albeit capping the level of payouts. In December, the Federal Reserve announced that banks could restart buybacks, which will be accretive to earnings.

Outside the banking sector, insurance companies are also benefiting from the recovery on the back of an acceleration in the increase in insurance rates for commercial businesses as losses due to business interruption claims and the cancellation or delay of sporting events such as the Olympics which hit profits in 2020, on top of others, fall away.

Asset managers and stock exchanges are also riding the recovery as fees generated from higher turnover from trading or the jump in assets under management from higher equity markets boosts profitability.

Against this background, share prices of some growth companies are hitting stratospheric multiples; as interest in stock markets and crypto currencies surges the risks of a repeat of 2000 come to mind.

The madness is being repeated. Share prices are jumping on little or no news. Companies with little or no revenues have seen multiples put on their business that defy logic as evidenced by insider selling. Some investors are saying value no longer matters. However, value always matters eventually.

If you had purchased a basket of global financials on the eve of the financial crisis in May 2007 you would have still made a return of more than 60% over the intervening period, despite the collapse in shares prices during the global financial crisis.

By comparison, if you had bought a basket of global technology shares on the eve of the collapse in technology shares in March 2000 you would still be nursing a loss of over 45% assuming you held for the same amount of time, because your starting valuation was so high. In fact, you would have had to wait another three years, over 16 in all, just to get your money back.

The financials’ sector, despite the recent bounce, has seen a significant derating in its relative valuation to global equity markets over recent years. Absolute valuations remain below historical averages too. Investors who have rightly been focused on more growth areas of the stock market in recent years risk missing out on the rotation into those areas of the market hit hard by lockdowns which have much more upside.

There are also significant opportunities within the sector outside the main banking and insurance sub-sectors. For example, Asian emerging market financials are benefiting from Asia’s better handling of COVID-19 which will allow a faster recovery.

They also continue to benefit from the low penetration of financial services to GDP relative to developed markets, underpinning their long-term growth potential. Payments companies continue to benefit from the shift from consumers using cash to card and the growth of e-commerce.

Global financials have risen by 55% over the past five years versus UK financials’ rise of only 17.5%. One way to get exposure is via the Polar Capital Global Financials Trust which was launched in 2013 to give investors a lower-risk way of getting exposure to the sector.

It has around 50% of its portfolio invested in bank shares predominantly in the US and Asia but also Europe and the UK, along with exposure to other subsectors such as insurance, payments and asset managers. It pays a dividend yield of close to 3%.

To buy this trust login to your EQi account

Select Polar Capital Global Financials Trust - GB00B9XQT119

Important Information

This document constitutes a financial promotion pursuant to section 21 of the Financial Services and Markets Act 2000 and has been prepared and issued by Polar Capital LLP ("Polar Capital"). Polar Capital is a limited liability partnership with registered number OC314700, which is authorised and regulated by the UK Financial Conduct Authority ("FCA") and is registered as an investment advisor with the US Securities & Exchange Commission ("SEC"). A list of members is open to inspection at the registered office, 16 Palace Street, London, SW1E 5JD.

This document does not constitute, or form part of, any offer or invitation to sell or purchase, or any solicitation of any offer to purchase or subscribe for, any shares in the Company in any jurisdiction nor shall it, or any part of it, or the fact of its distribution, form the basis of or be relied on in connection with or act as any inducement to enter into, any contract therefore. It is for information purposes only and is not designed to contain information material to an investor’s decision to invest in the Company. Polar Capital is not rendering legal or accounting advice through this announcement; viewers should contact their legal and accounting professionals for such information. All opinions and estimates in this announcement constitute the best judgement of Polar Capital as of the date hereof, but are subject to change without notice, and do not necessarily represent the views of Polar Capital. Potential investors should be aware that any investment in the Company is speculative, involves a high degree of risk, and could result in the loss of all or substantially all their investment. Results can be positively or negatively affected by market conditions beyond the control of the Company or any other person. This announcement may include statements that are, or may be deemed to be, "forward-looking statements". These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. This document has not been approved by any competent regulatory or supervisory authority.

Click to see more:

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.