Uncovering Europe’s hidden gems

JPMorgan European Discovery Trust plc

European equities are back in vogue, with massive fiscal and monetary support, economic re-openings, and a sizable valuation

discount relative to the US. All of which provide an attractive macro backdrop for investor.

Capitalising on this exciting opportunity requires a flexible and dynamic investment strategy. The JPMorgan European Discovery Trust plc invests in European smaller companies, seeking out entrepreneurial businesses that are often leaders in their market niches and/or have growth prospects that are underappreciated by the market.

Stock selection is guided by a disciplined investment strategy with a long track record of discovering Europe’s lesser known corporate leaders, providing attractive long-term return potential.

The trust is focused on bottom up stock selection but from this overarching investment themes often emerge. These new structural growth themes often appear in the small cap space first which allows this trust to gain early exposure to new exciting growing companies.

Currently some of the strongest growth potential is seen in companies benefitting from the increasing focus on health and wellness, technology-driven disruption, and an acceleration in efforts to tackle climate change.

The trust has successfully benefited from previous global investment trends. For example, the trust gained exposure to the opening up of China to luxury goods companies through investments in companies such as Ferragamo.

The trust also benefited from technology improvements in the medtech space via several holdings, including dental implant leader Straumann, while the move to digital downloads in the video games sector supported our holding in Ubisoft. All these investments generated strong returns for the trust before being sold when the stocks became large caps, with the proceeds used to invest in new small-cap opportunities.

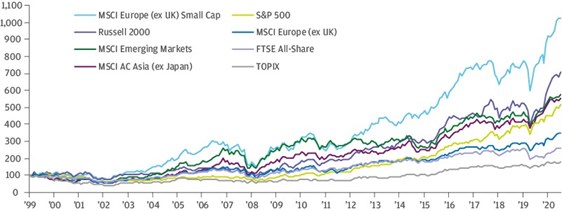

Smaller stocks with big potential

Notwithstanding some brief, but significant, periods of underperformance, the smaller European stocks, that the JPMorgan European Discovery Trust focuses on, have not only outperformed large caps in Europe over the long-term, but have also outperformed most other markets globally. The MSCI Europe Small Cap Index is one of the best-performing indices in the world over the last two decades.

A compelling long term asset class

...European small cap have produced long term equity returns amongst the best in the world

Past performance is not a reliable indicator of future results

Source: Bloomberg. All series are rebased to 100 as at 31 December 1999 to 31 December 2020. All indices in GBP and include reinvested dividends. Indices do not include fees or operating expenses and are not available for actual investment. MSCI Europe Inc UK Small Cap index was launched in 2001, the data prior to that is back tested.

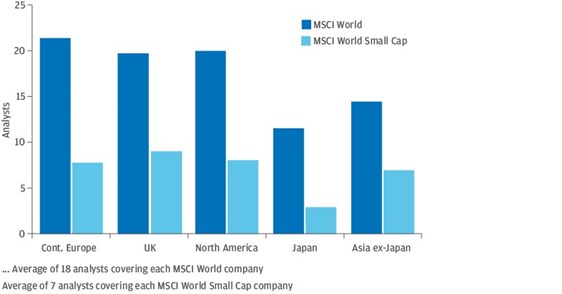

Just as attractive for investors is the fact that, although Europe's smaller companies have outperformed over many years, the sector remains underappreciated and under analysed by the market. This provides an opportunity for specialist active managers to take advantage of these market inefficiencies.

Greater scope to pick winning stocks

We believe the inefficiencies of the smaller company market and its lower sensitivity to the macroeconomic backdrop relative to larger caps offers greater opportunities for active stock pickers.

- Under-appreciated potential: A particularly powerful long-term consideration is the lower analyst/investor coverage across the European small cap universe, which we believe creates a less efficient market and more room for active managers to generate alpha.

Source: J.P. Morgan Asset Management, Bloomberg, data as of 30 June, 2019.

- More corporate activity: Smaller companies are more likely to be acquired than larger companies, providing an additional source of investor returns. Over the years we have owned a number of companies that have been acquired including Bulgari, Tag Heuer, Jazztel, Moleskine, Altran, Grandvision, and Dialog Semiconductor.

- IPOs: When companies first list on the stock market they tend to be smaller companies and this provides a constant stream of new and exciting investment opportunities for the trust.

- Greater exposure to stock-specific returns: Relative to larger companies, investing in smaller companies provides greater exposure to stock-specific factors and less to general macro-economic conditions. As a result, we believe the JPMorgan European Discovery Trust plc provides a greater ability to generate alpha through stock picking. This is especially true in periods of high volatility as the disconnect between share prices and intrinsic value can grow significantly.

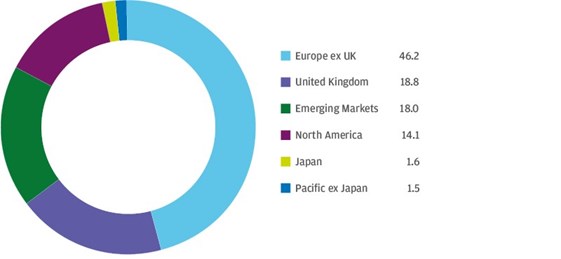

- International diversification: The ability to add value through stock picking is further enhanced by the diversified revenue exposure of Europe’s smaller and underexplored companies. A significant proportion of small cap revenues comes from North America and emerging markets including China. With the majority of revenues generated outside the European Union, the country in which a company is listed has minimal impact on its long term growth potential.

MSCI Europe Small Cap Index revenue exposure (%)

Source: FactSet and J.P. Morgan Asset Management. As at 30 September 2020.

- Valuation discount: The significant market correction caused by the Covid-19 pandemic created the opportunity to uncover many exceptional companies with solid business models that were trading on very attractive valuations. The opportunities created have reinforced the quality of the European Discovery portfolio.

A fund that’s focused on exciting ideas

The JPMorgan European Discovery Trust plc operates in inefficient markets where active stock picking is essential. This is the essence of our ‘Discovery’strategy: the managers constantly scour Europe to uncover great investment opportunities, using an investment approach that combines the best of fundamental research and the best of quantitative analysis. Company meetings and engagement on environmental, social and governance issues are a key part of our research.

The aim is to uncover well managed stocks that are at an early stage in their development, so we can share fully in their future growth.

Currently, the trust’s managers are finding particularly exciting opportunities in the three global trends that have been most clearly highlighted by the global pandemic: health and wellness, technology and tackling climate change.

In the health and wellness arena, recent investments have included Technogym, an Italian manufacturer of premium fitness equipment for both commercial gyms and home use. This is an exciting stock that is tapping into the strong post-pandemic focus on health and fitness.

Technology is a particularly fertile area for the European small cap investor. Although this asset class is not always associated with technological innovation, it is in fact home to many global leading technology enablers. Swedish software company, Fortnox, provides financial software for small and mid-sized companies. Fortnox is a great example of a disruptive smaller company. It is completely cloud based and so does not have a legacy business acting a growth headwind unlike its large cap competitors.

When it comes to fighting climate change, European smaller companies are leading the field. We expect the European green deal to help bolster what is already solid demand for companies that are driving the transition to a low carbon economy, such as Scatec, the Norwegian renewable energy producer specialising in emerging markets.

Why JPMorgan European Discovery Trust plc?

- Experienced Team – The two named portfolio managers have an average of 23 years’ experience and are supported by a team of 100+ equity professionals. Our team-based approach provides in depth coverage of an extensive universe of stocks (~1,500 names) and the ability to source entrepreneurial leaders.

- Disciplined, long-standing process combining the best of quantitative and fundamental analysis – Bottom-up fundamental approach to stock selection, preferring attractively valued, well-managed companies with an improving outlook.

- Flexible investment approach – The portfolio managers are able to invest in sectors where they see the best current growth opportunities. The overarching investment themes that have emerged from this bottom-up stock selection currently include environmental improvement, wellness and technology driven disruption.

Find out more about JPMorgan European Discovery Trust >

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained free of charge from JPMorgan Funds Limited or www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.