Top rated Investment Trusts for 2022

We unveil the winners of our ratings for 2022 in the Growth, Income & Growth and Alternative Income categories…

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Kepler’s investment trust ratings seek to identify the top-performing closed-ended funds in the Growth, Income & Growth and Alternative Income categories. Our ratings are designed to capture attractive and persistent performance characteristics and to reward long-term success in the market of operation.

Like all quantitative systems they are backward-looking, but we have attempted to reward those trusts which have done well in the context of their own goals and benchmarks, and which have done so for a sustained period. As the selection system is entirely quantitative, it allows us to set aside all personal biases and views – and all commercial relationships – and look at the universe in a purely objective way (in fact, only 48% of the trusts across the three shortlists are clients of ours). This year’s winners of the ratings are presented below, along with a discussion of how last year’s rated trusts performed.

Our methodology

To identify the top growth trusts, we start by looking at performance versus the benchmark. For us the information ratio is the key metric. This looks at the outperformance of a fund versus its benchmark and then relates this to the extent of divergence from the benchmark, or the extra risk taken. In other words, it seeks to identify whether the active risk relative to the benchmark taken by the manager has been rewarded with outperformance. We then look at the performance of a fund in rising markets versus its performance in falling markets – the upside / downside capture ratio. We think this has two attractions. The first is it reflects the ‘loss aversion’ of the average investor. Behavioural finance teaches us that investors prize avoiding loss more than they do achieving a quantitatively equivalent gain. This is captured by an upside / downside capture ratio above one, which means that the fund has a tendency to avoid losses by a more significant degree than it makes gains in rising markets. The second attraction is that it allows us to consider defensive and aggressive strategies on a more level playing field. A trust which does exceptionally well in rising markets and is level in falling markets could rank the same as a trust which protects very well in falling markets but only keeps up in rising markets.

In order to create fair comparisons between funds we have divided our universe into “super sectors” of asset classes: large and mid-cap equity funds, small cap funds, fixed income or equivalent funds and property funds. This is intended to reflect the fact that generating alpha in particular is much easier in small caps, so comparing small cap managers with large cap managers is unfair. It also overlooks the risks that small caps bring – volatility, liquidity – which mean that it is not inherently superior to large cap investing despite the advantages with regards to alpha. We rank trusts within their super sector on all quantitative metrics. In order to reward persistence, we review performance over a five-year time period, which makes it much harder for a single year to distort results. We also exclude trusts which have had a manager change in the past three years.

It perhaps goes without saying that all our analysis is based on NAV total return performance, which reflects the strategy and manager decisions, rather than share price, which can reflect many other factors. We would never envisage such a rating being used on its own to determine investment decisions and clearly with investment trusts the discount (level, as well as volatility) and the quality of the board all need to be considered too. As importantly, given that quantitative studies are backward looking, investors need to make a judgement about the likelihood of past performance patterns persisting in ever-changing markets. By looking over a long time period we hope to capture a broader set of market conditions, but some trends last for much longer than five years.

For our income and growth ratings, we start with the growth ratings (which are measured on total returns). We then look at current yield and at dividend growth over five years. To win the rating a trust needs to have a 3% yield and 3% per annum dividend growth over the past five years as a minimum, allowing for high yielding funds and dividend growth funds to be considered together. Given the lower number of trusts which hit this boundary, we have been more relaxed in our total return screens, not insisting on minimum targets for information ratio and upside/downside capture ratio as we have for the growth picks, but simply scoring the trusts in the relevant super-sector. Once we have screened out the trusts which don’t meet the yield and dividend growth tests, we order the trusts by their quantitative score on our growth screens. We apply the same manager tenure screen for both ratings.

Last year we introduced an alternative income rating in order to analyse the top performers in this relatively new and rapidly growing space. We think for the most part trusts in the infrastructure, renewables and related sectors are held for a stable and high income, most likely by those living off their income. High yield is likely more important than income growth. We have developed a simple screen which shows those trusts which have at least maintained their NAV and at least maintained their dividend in nominal terms over the past five years. With the alternative income space being relatively young, there are not a huge number of trusts with a long track record, and just applying these two screens whittles the space down to just 12 trusts.

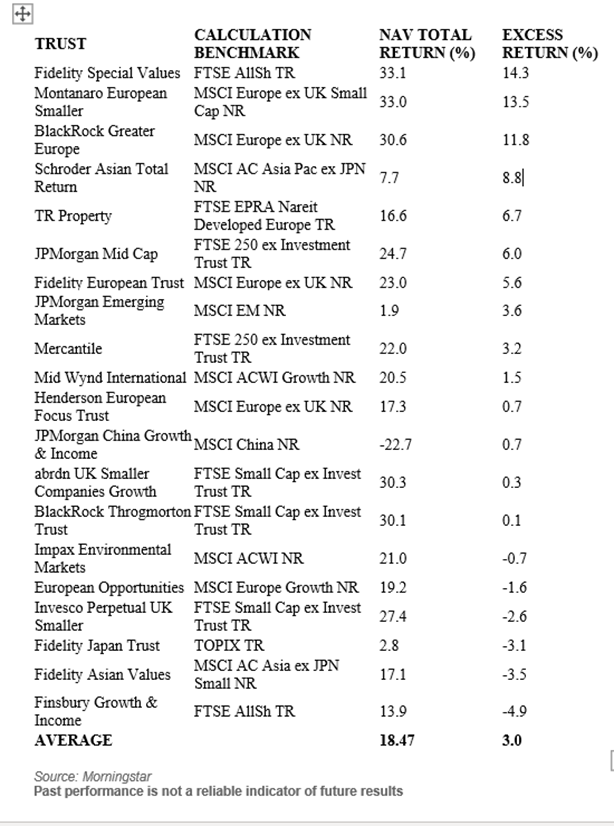

How did our 2021 rated trusts do?

Our growth-rated trusts delivered another year of solid outperformance. Following an exceptional 2020, in which they outperformed their benchmarks by an average of 10 percentage points, 2021 saw average outperformance of 3pp. Fidelity Special Values (FSV), Montanaro European Smaller Companies (MTE) and BlackRock Greater Europe (BRGE) all delivered double digit excess returns. There was no single performer to do as well as 2021’s JPMorgan China Growth & Income (JCGI), which outperformed the MSCI China Index by 55% in that year. In fact, JCGI returned to earth somewhat, with marginal outperformance of an index which ended the year 22% down. However, it retains its rating, given the long-term focus of our system.

Performance of 2021 Growth Rated Trusts

Our 2021 income & growth rated returned more or less the same as their benchmarks on a total return basis on average, not a bad result given their focus on income and dividend growth. In 2020, income managers were disadvantaged by a market which favoured growth for the most part of the year. In 2021 the reflationary rally at the start of the year favoured income mandates (given the latter often have a tilt to value sectors) but a late recovery in growth versus value has meant that overall, the stylistic environment has been a neutral influence.

Performance of 2021 Income and Growth Rated Trusts

The standout performers were Schroder UK Mid Cap (SCP), TR Property (TRY) and Chelverton UK Dividend (SDV). SCP falls out of the list this year (see below) as strong returns have seen its share price yield drop. TR Property’s strong results have seen it qualify for a growth rating this year, which takes priority, testament to the strong long-term relative performance of manager Marcus Phayre-Mudge. TRY invests in the equity of property companies, with a flexible Pan-European remit. Absolute returns were strong from the many UK trusts in the list, in particular for those with a small and mid-cap focus. Asia and emerging markets were the worst performers across the Growth and Income & Growth lists.

Revealing the top-rated growth trusts for 2022

Below we show the twenty trusts which have won a growth rating for 2022, based on their long-term superior performance characteristics, ordered by raw score.

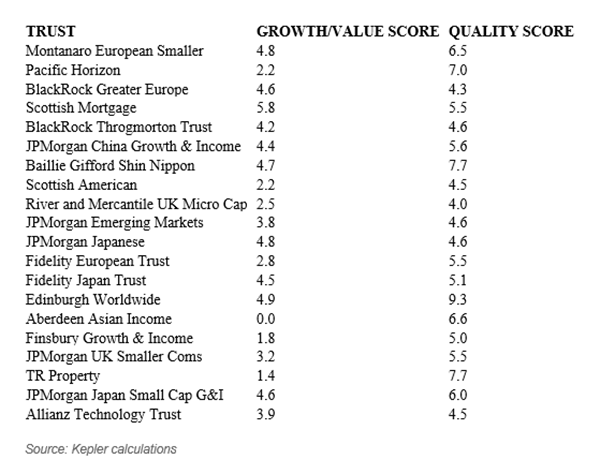

2022 Growth rated Trusts

We also show their relative positioning on our growth/value and quality screens. These use raw Morningstar data on underlying holdings to place all investment trusts on these axes. Our Growth/Value scores are inflated or deflated based on the consistency of the stylistic bias over time and the dispersion of the portfolio on this metric, and a neutral score would be 0. Unsurprisingly there remains a strong bias to growth strategies after their long-term success, despite the reflationary rally in late 2020 and early 2021. More stylistically neutral exposure is offered by Aberdeen Asian Income (AAIF), TR Property and Finsbury Growth & Income (FGT), although we stress that a score above 0 still implies a tilt to growth. Scottish Mortgage (SMT) and Edinburgh Worldwide (EWIT) have the highest growth score amongst the top-rated funds, unsurprisingly.

SMT doesn’t score so highly on quality, however, perhaps reflecting their penchant for selecting early-stage businesses in recent years. This quality score is awarded on a scale of 1 to 10, and scores for the top-rated trusts on this metric are also asymmetrical, with the majority of trusts being above 5 and those below being only marginally so.

One new entrant to the list is River & Mercantile UK Micro Cap (RMMC). RMMC had previously failed the manager tenure screen, but George Ensor has been in place for over three years’ now. RMMC has performed very strongly in recent years and offers exposure to the microcap space which is often overlooked and hard to access outside the closed-ended space. Aberdeen Asian Income, JPMorgan UK Smaller Companies (JMI) and Scottish American (SAINTS) are all new entrants while TR Property has been promoted from the Income & Growth list.

Revealing the top-rated income & growth trusts for 2022

The winners of the Income & Growth rating are presented below. We envisage these as being the sort of trusts that the typical income investor pre-drawdown or at the beginning of drawdown might look at, with a balance between income and dividend growth characteristics. Similarly, they might be more appropriate for those who want to invest in dividend-payers and compound their earnings over time.

2022 Income and Growth Rated Trusts

There has been more turnover in this list than there has been seen since we started calculating these ratings, despite the fact our focus on five years is intended to provide more stability. We think this is due to the difficulties for income managers over the past few years in keeping up with the market. For the majority of the past five years growth has been in favour and value stocks, which tend to yield more, have suffered. There was a sharp cyclical rally in late 2020 and early 2021, but this was short-lived and tended to favour the battered, lower quality companies. There are ten organic additions Aberdeen New Thai (ANW) was folded into a new China trust during the year). Notably the average Growth/Value score of 2022’s list is significantly higher than 2021’s, with a score of 0.8 versus -1.8. The average quality score has fallen from 7 to 5.5. There are still options for the investor who favours value however, such as new entrant JPMorgan Russian Securities (JRS), riding a wave of resurgent commodity prices, or North American Income (NAIT).

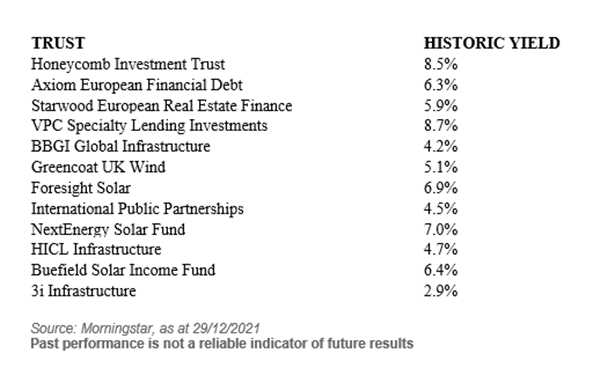

Revealing the top-rated alternative income trusts for 2022

Last year we initiated our Alternative Income rating. Due to the youth of the sector, only nine trusts passed our screens. This year it has risen to 12. These trusts aren’t subjected to the same screens, which would be meaningless on NAV given how the majority of the trusts calculate those NAVs. However, we have aimed to set a decent target that we think most people looking for a high income would require or prefer: maintaining a dividend without running down the NAV. The trusts below have managed to do that over a five-year period, so in a space full of relatively new launches and new asset classes can be said to have provided “proof of concept”. Of course, that does not mean they will continue to be successful in the future, but it might be a good starting point for further analysis.

2022 Alternative Income Rated Trusts

Notably the new entrants include Honeycomb (HONY), which now has a track record long enough for inclusion. HONY is one of the highest yielders on the list, offering over 8% on a historic basis. It generates this income by investing in asset-backed loans. This is a complex market which requires a specialist manager and has risks to be aware of, but HONY has performed well, even through the disruption of the pandemic.

Conclusions

We have created a series of quant screens which we think highlight the most attractive characteristics investors could ask of a trust, with three lists aimed at different core goals: long-term growth, income and growth and high and stable income. Any fund selection process could only begin with such a series of screens, and there are many hidden risks and factors to consider, but we think it could be a good starting point for idea generation. The innate flaw of quant systems is that they inevitably favour what has worked in the past, however much the analyst tries to balance this tendency. In such a tumultuous time it is worth considering whether a strategy which worked well pre-COVID will continue to do the same. Another factor we have not considered is share price discount, which can be very important to returns. In our view over the long run, except in some extreme scenarios, NAV should be far more important to the returns experienced by shareholders than discount movements. However, this has to be taken into consideration too.

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.