The future of consumption: Ecommerce isn’t just Amazon….

Capital at Risk. The content of this document does not constitute investment advice, nor an offer to buy any product or make an investment.

By Kevin Carter, CEO of the EMQQ – The Emerging Markets Internet & Ecommerce UCITS ETF

Overview

Ecommerce – the buying and selling of goods and services online has become a global phenomenon. In the western world, traditional highstreets and shopping malls are under pressure from their ‘ecom’ rivals whose product ranges, delivery speeds and convenience are improving every day.

The high street is likely to look very different for consumers in the post-Coronavirus world. Those of us in the UK have already seen names like Laura Ashley, Debenhams, Topshop, Carluccio’s, Oasis and Warehouse go into administration- and others are likely to follow.

But the big winners from Coronavirus have been providers of ecommerce and online services – with consumers blocked from their favourite shops, many have turned to online stores to buy what they need. Amazon, for example has seen surging share prices as consumers drop a reported $11,000 a second on the site. Companies with strong ecommerce offerings have had an opportunity to reach a new client base – and one that can be retained in future.

However, in the developing world, ecommerce is playing a different role – providing first-time access to goods and services for people who never had shopping malls or high streets in the first place. This revolution is being driven by the falling costs of smartphones which are giving people their first computer, their first way to connect to the outside world and the first way for them to buy or sell their goods in a wider market.

While Amazon is synonymous with ecommerce in the west, there are a wide range of companies serving emerging market consumers that are less familiar to western investors.

With more than half of the world’s populations, more than half of the world’s wealth and huge growth potential, more investors are looking at how they can gain exposure to the ‘Amazon’s of China’, ‘The Google of Russia’, ‘The Uber of India’ and other ecommerce providers serving emerging market consumers.

The appeal of emerging markets is based on their demographics and rapidly evolving economies: emerging markets contain 85% of the world’s population - a huge number of potential buyers.

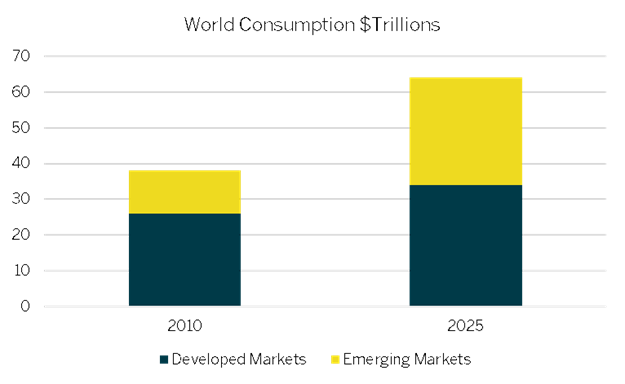

Moreover, emerging markets are getting wealthier – with rising middle classes, consumers in those regions have greater disposable income. By 2025, annual consumption in emerging markets is predicted to reach $30 trillion – what consulting company McKinsey calls “the biggest growth opportunity in the history of capitalism”.

For illustrative purposes only

Simply put, if company’s like Amazon, Uber, Facebook and Google can generate huge revenues and shareholder value while only targeting a small fragment of the world’s population, then the opportunity for companies that can unlock the spending power of emerging market consumers must be much larger.

For example, in China, there is a holiday called ‘Singles Day’ – November 11th. On Singles Day in 2020, Alibaba - a company often described as ‘The Amazon of China’ reported an astonishing $56 Billion in sales - dwarfing the previously referenced $11,000/second spent on Amazon during peak CoronaVirus.

With the pandemic driving consumer behaviour online at an accelerated rate, demographics and regions that have remained slow or even resistant to adopting a more digitised lifestyle seem to have relented and started to convert. In Latin America, where online retail sales only account for 5% of total sales, is expected to surge to 25% in one decade according to a recent HSBC study.

Rajiv Jain, one of the HSBC analysts even proclaimed, “Covid-19 could do to Latin America what SARS did to Chinese e-commerce in the early 2000s.” These projections highlight the potential that exists not just in the more mature ecommerce market of China, but the likes of Brazil, Chile, Mexico, Indonesia, India, Vietnam and many other geographies now incentivised to accelerate their mobile adoption rates.

The Latin American leader in Ecommerce is Argentinian-based Mercadolibre (MELI), which posted a return of over 45% for the month of May. With the virus continuing to spread in Brazil and elsewhere in Central and South America, MercadoLibre, has disproportionately benefited over competitors due to its more robust supply chains and logistics management that’s been capable of meeting the tremendous surge of demand.

Mercadolibre also represents how the macro conditions that continue to drive China’s digitisation, are also being felt throughout developing economies, but offering the possibility of even greater upside as they come off a much lower base and much earlier in their digitisation cycle.

In the Latin American region, only 34% of consumers under the age of 15 buy goods online, compared to the 74% in the UK and just over 60% in China. This adoption gap is closing fast however as the virus has created an extra incentive and catalysing growth.

After reporting to register 1.7 million new customers for the month alone, MELI COO, Stelleo Tolda proclaimed on his last earnings call that they are at a “point of no return” and “digitisation will stabilise at a much higher level”.

Investing in the Emerging Market Ecommerce Opportunity

While investors can and should do their own research on stocks that are involved in internet and ecommerce in emerging markets, there is an alternative in the form of an exchange traded fund (ETF).

An ETF is a basket of stocks that tracks the performance of an index such as the EMQQ Emerging Markets Internet and Ecommerce Index. This index comprises leading internet and ecommerce companies that serve emerging markets such as search engines, online retailers, social networks, online gaming and e-payment systems.

ETFs trade on a stock exchange and can be bought in the same way as a share through a broker. It is an accessible way to buy into a theme without having to pick individual stocks. Of course, like shares, prices can go down as well as up and an investor’s capital is at risk.

Click to visit:

Important Information

The content in this document is issued by HANetf Limited (“HANetf”), an appointed representative of Mirabella Advisers LLP, which is authorised and regulated by the Financial Conduct Authority (“FCA”). For professional clients only. Past performance is not a reliable indicator of future performance. Any historical performance included on this document may be based on back testing. Back testing is the process of evaluating an investment strategy by applying it to historical data to simulate what the performance of such strategy would have been. Back tested performance is purely hypothetical and is provided on this document solely for informational purposes. Back tested data does not represent actual performance and should not be interpreted as an indication of actual or future performance. The value of any investment may be affected by exchange rate movements.

Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice. These products may not be available in your market or suitable for you. The content of this document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment. An investment in an ETF is dependent on the performance of the underlying index, less costs, but it is not expected to match that performance precisely. ETFs involve numerous risks including among others, general market risks relating to the relevant underlying index, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

The information contained on this document is not, and under no circumstances is to be construed as, an advertisement or any other step in furtherance of a public offering of shares in the United States or any province or territory thereof, where none of the Issuers or their products are authorised or registered for distribution and where no prospectus of any of the Issuers has been filed with any securities commission or regulatory authority. No document or information on this document should be taken, transmitted or distributed (directly or indirectly) into the United States. None of the Issuers, nor any securities issued by them, have been or will be registered under the United States Securities Act of 1933 or the Investment Company Act of 1940 or qualified under any applicable state securities statutes. The products discussed on this document are issued by HANetf ICAV.

This document may contain forward looking statements including statements regarding our belief or current expectations with regards to the performance of certain assets classes and/or sectors. Forward looking statements are subject to certain risks, uncertainties and assumptions. There can be no assurance that such statements will be accurate and actual results could differ materially from those anticipated in such statements. Therefore, readers are cautioned not to place undue reliance on these forward-looking statements. HANetf ICAV is an open-ended Irish collective asset management vehicle which is constituted as an umbrella fund with segregated liability between sub-funds and with variable capital organised under the laws of Ireland and authorised by the Central Bank of Ireland (“CBI”). Investors should read the prospectus of HANetf ICAV (“HANetf Prospectus”) before investing and should refer to the section of the HANetf Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in the shares.

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.