Six Reasons to Invest in the Mercantile Investment Trust

The Mercantile Investment Trust invests in medium and smaller UK companies. The managers’ objective is to spot businesses with the potential to grow into ‘tomorrow’s market leaders’.

The past being an indicator and not a guarantee, it is interesting to look back at returns from this segment of the market which have historically outpaced those of the UK’s largest FTSE 100 companies, and Mercantile’s share price and dividends have significantly outpaced inflation over the past five years, an important consideration in today’s economic climate. In addition to this strong performance track record, Mercantile offers investors other compelling features, let’s take a look at a few of them:

Mercantile’s investment team, led by Guy Anderson and Anthony Lynch, believe that investing in the UK’s medium and smaller companies today is as attractive as ever, despite the challenges businesses face due to rising costs and increasing taxes.

Pricing power and long-term competitive strength have always been a focus for the managers when choosing which businesses to back. These are the businesses that are best placed to navigate the current environment and become the market leaders of tomorrow.

This strategy underlies the trust’s 30 year track record of delivering a stable and rising income. Even in difficult times, careful management of its income reserves has enabled Mercantile to maintain or increase its annual dividend through a variety of crises, such as the bursting of the Dot-com bubble, the Global Financial Crisis and the Covid-19 pandemic.

Mercantile’s investments consist of a mixture of long-held positions in companies which continue to show strong growth as they emerge from the pandemic and evolve into market leaders, as well as more recent investments including companies newly floated on the London Stock Exchange.

The rigorous investment process followed by the experienced investment managers includes regular interaction with company management teams, with over 350 meetings taking place each year. They are always on the lookout for the most exciting medium and smaller-sized companies, focusing on identifying those with the best prospects. The fundamentals are always carefully considered: the companies must have sound finances and strong management, the outlook for the businesses must be positive, and the shares must be the right price.

When the managers invest in newly floated companies, it is because they believe in the long-term future success prospects of the businesses, rather than because they are hoping to make a quick profit.

In the same way, Mercantile’s managers do not intentionally invest in companies thought to be takeover targets. If this does happen, they argue that it is a by-product of their strategy of searching out exceptional companies with good prospects and paying a reasonable price for them. If a company held in the portfolio is approached, the offer is assessed and dealt with on its merits.

Looking ahead, the investment team believe there are reasons to be optimistic about the outlook for UK companies this year. They expect the post-pandemic economic recovery to continue and companies’ earnings growth to be strong. While businesses and consumers face higher costs, they believe the type of firms they hold will remain robust.

Another factor working in investors’ favour is that the UK stock market is still looking undervalued in comparison to other developed markets. International investors have been wary of the UK since the Brexit vote and the uncertainty it produced. However, as the domestic and global economies continue to recover, the low valuations of UK companies and their scope for profit growth are becoming increasingly attractive.

While unexpected obstacles can emerge at any time, such as further Covid-19 variants or geopolitical issues, and these might impact short-term performance, Mercantile’s managers are positive about the future. They believe the type of medium and smaller companies they focus on are robust and will continue to produce good returns.

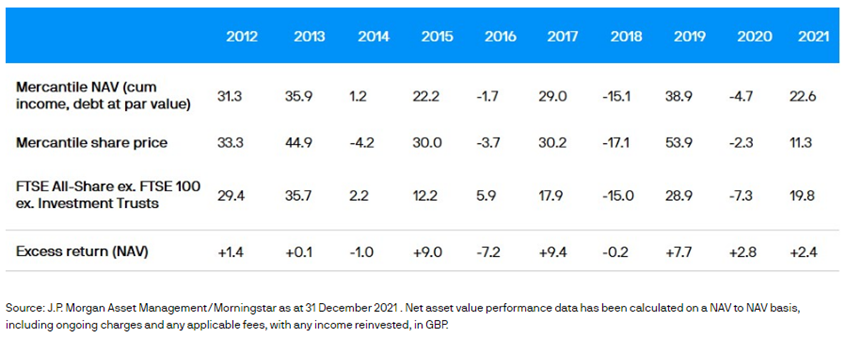

Calendar year performance, net of fees (%) as of 28 February 2022

Company risk profile

- External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds and income could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions.

- This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down.

- This Company may also invest in smaller companies which may increase its risk profile.

- The share price may trade at a discount to the Net Asset Value of the Company.

- The single market in which the Company primarily invests, in this case the UK, may be subject to particular political and economic risks and, as a result, the Company may be more volatile than more broadly diversified companies.

Companies listed on AIM tend to be smaller and early-stage companies and may carry greater risks than an investment in a Company with a full listing on the London Stock Exchange.

More information on The Mercantile Investment Trust Plc >

Watch: Guy Anderson at the 2022 Master Investor Show

Hear from Portfolio Manager, Guy Anderson, as he discusses the case for investing in medium sized companies, and why The Mercantile Investment Trust is the home of tomorrow’s UK market leaders

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management.

Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained free of charge from JPMorgan Funds Limited or www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.