Results analysis: Scottish oriental smaller companies

Disclosure – Non-Independent Marketing Communication. This is a non-independent marketing communication commissioned by Scottish Oriental Smaller Companies. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

SST’s tilt toward India has contributed to a strong set of results this year…

- Scottish Oriental Smaller Companies (SST) has reported strong absolute returns for the year ending 31/08/2021 delivering NAV total returns of 28.4% compared to a loss of 13.2% in FY 2020. SST is not managed to a benchmark, but the results compare to total returns of 14.7% for the MSCI AC Asia ex Japan Index and 37.8% for the MSCI AC Asia ex Japan Small Cap Index.

- The board has maintained the dividend at 11.5p, using a contribution from the revenue reserves to do so. Earnings per share rose from 8.2p in 2020 to 9.0p in 2021.

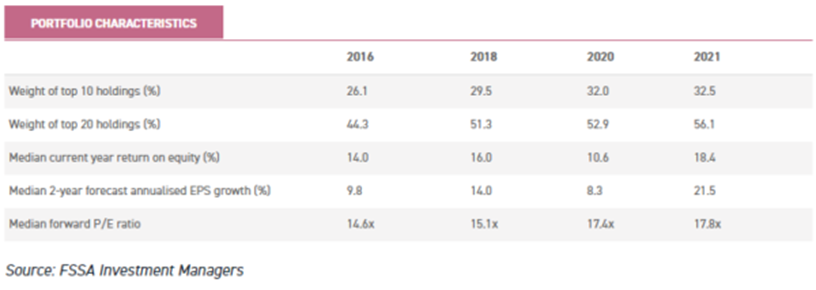

- Following the impact of the pandemic, the management team estimates the median forecast EPS growth on the portfolio will be 21.5% per annum for the next two years, illustrating the strength of the recovery coming through at the company level.

- SST has long had a significant position in Indian companies based on the managers’ view of company-level fundamentals rather than a call on the market. In FY 2021 this benefitted the trust as the Indian market performed strongly. Many of the trust’s top performers are listed in that country, including IT services company Mphasis, real-estate developer Mahindra Lifespaces and auto component manufacturer Mahindra CIE Automotive.

- In FY2020 the manager, FSSA Investment Managers, implemented some reforms to the process aimed at improving performance. Amongst other things this saw the trust take on gearing which has been helpful in a rising market.

- The portfolio at the end of the year displayed higher return on equity and earnings growth expectations than the market. The chairman comments: “Despite the present background of concerns about China … [the managers] … are enthusiastic about the outlook for the companies in our portfolio. We share that optimism.”

Kepler View

Scottish Oriental Smaller Companies (SST) invests in market-leading businesses which have a market cap of below $5bn at the time of investment. These companies are chosen for their low levels of debt, strong management teams, and ability to compound earnings consistently over the long run at high returns on invested capital.

In FY 2020 the board and manager implemented a number of changes intended to improve performance. This included naming Martin Lau as co-manager with Vinay Agarwal, and the addition of the first structural gearing for many years.

The market-capitalisation limit was also increased from $3bn to $5bn and the mandate broadened to include Australasia and Japan. The first indications are the changes have been helpful, judging by the strong results reported for the latest financial year, with gearing being beneficial – although we note the trust had yet to buy any stocks in Australasia or Japan.

Historically, SST, which has been run to the same basic strategy by the same team since launch in 1995, has performed well after major global crises. Prior to the pandemic, the two most recent were the 2007/2008 financial crisis and the bursting of the tech bubble in 2001.

In our view the conservative quality growth style implemented by the managers could do well in the post-pandemic period too, as economies recover from the virus and the restrictions. Quality companies typically have lower levels of debt, giving them more flexibility to invest and less sensitivity to funding costs. This can help them take market share from weaker competitors in tough times, and SST’s managers report this has been visible in the results from a number of portfolio companies.

The portfolio at the end of the financial year displays attractive characteristics which could be promising for future returns. While the valuation of the portfolio has risen somewhat on last year, the team forecast earnings growth of 21.5% a year over the next two years on their portfolio companies. The table below shows the progression of the portfolio over recent years, with an improvement in growth characteristics, higher return on equity and increasing concentration, which reflects the manager’s conviction in the portfolio’s top holdings.

Vinay and Martin’s portfolio is built entirely from the bottom-up. The strategy is to identify companies with strong fundamentals and management teams with track records of solid performance in tough times, then invest for the long-term alongside management who are similarly committed.

This strategy has persistently led to a strong bias towards India. In 2021 this was helpful, and the low allocation to China was also a tailwind. Both positions had hindered the trust in recent years. SST was also helped by the strong performance of small and mid-caps in India. These had underperformed large caps in 2018 and 2019 as the Indian economy struggled, but in the broad-based rally after vaccines were unveiled they have led the market.

We think political concerns about the power of large-cap tech and desire for local supply chains could see SMIDs do better globally than they have in recent years – if the recovery from the pandemic proceeds relatively smoothly.

Indonesia is another country the team has favoured, finding a number of high-quality companies in a fast-developing market with low penetration of some basic goods and services and high expected growth rates. Over 2021 the trust increased its weighting in Taiwan, Malaysia, Singapore and Thailand as it found attractive bottom-up opportunities and we believe it offers good diversification to the more benchmark-aware GEM and Asia Pacific strategies.

SST trades on a wide discount of 10.1% as of 20/10/2021 (Source: JPM Cazenove) which could prove an interesting long-term entry point – although it has tended to trade on a wide discount over the past few years. The board has been active in using buybacks to moderate this, which could provide some protection on the downside.

See the latest research on Scottish Oriental Smaller Companies Trust here >

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.