Investing basics: a simple guide to volatility

Investors have much to think about when choosing and understanding investments; in particular volatility and the impact it can have on their investment – writes Christian Leeming.

Extreme market volatility during the Global Financial Crisis, an more recently during the Covid-19 pandemic demonstrated how markets can swing wildly. Understanding volatility is therefore vital to the whole process of choosing the right investments.

What is volatility?

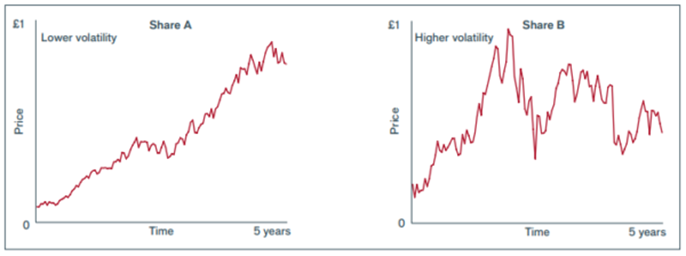

Volatility is how sharply and how frequently a fund or share price moves up or down over a certain period of time (see example below)

What causes volatility?

Volatility can be triggered by any number of factors. The UK stock market, for example, can fluctuate because of various factors both domestically and overseas; economic data from around the world, as well as key political events can trigger significant market movements.

Periods of losses/downturns can be followed by upswings, also known as rallies, and vice versa, but this is the very nature of the stock market.

Can you measure it?

The most common measure of volatility is standard deviation. This measures how much the value of an investment moves away or deviates from its average (mean) value over a set period of time, i.e. how much it rises and falls.

The higher the volatility the greater the standard deviation.

The examples below show shares with higher and lower volatility. Share A has lower standard deviation (volatility) compared to share B which has higher standard deviation.

Forecast volatility attempts to use standard deviation to forecast future variations in returns. The higher a forecast volatility figure the more an investment may move up or down over time.

What does it mean for my investments?

Generally investors are happier with lower volatility even if this could mean making less money over time. Investors worry most about volatility when markets are falling. When this happens, remember any loss or gain is only realised when you sell your holdings.

Investing for the long term means short term volatility is not necessarily a reason to panic and make drastic changes.

It can potentially work to your advantage if you invest a monthly amount. When prices go up the value of your investment rises, and when they go down your payment buys more.

This is often called pound cost averaging; however this method, or any other is no guarantee of success.

How can I best deal with volatility?

Spreading risk through diversification is often said to be one of the golden rules if investing. Diversifying across a range of asset classes and markets should ensure your savings go to work in different markets, and crucially reduce exposure to one individual area as one asset class may go up while another goes down.

Strategies of long term investing and regular saving should help smooth out any bumpy rides. Matching your attitude to risk to your investments is crucial to getting the right portfolio for your needs.

Top tips:

- Volatility is how sharply and how frequently an investment moves up and down over a certain period

- Periods of losses can be followed by gains and vice versa

- Strategies of long-term investing, diversification and regular saving can potentially smooth out any bumpy rides

- Any loss or gain is only realized when you sell your investments

- By understanding your attitude to risk and response to volatility you should be able to find suitable investments

Click to visit

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.