Finding quality companies in volatile markets

By Charles Luke, Investment Manager, Murray Income PLC

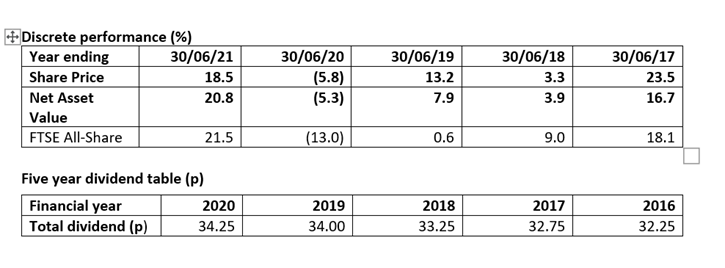

- In a see-saw year for markets, income generation in the Murray Income Trust has held up well

- Our key priorities in the Trust are to be ‘dependable’, ‘diversified’ and ‘differentiated’

- We see better times ahead for the UK equity income sector

This has been a see-saw year for investment markets. In the early stages of the pandemic, investors focused their attention on companies with reliable growth. Since the vaccination programme has allowed economies to reopen, there has been a rotation to ‘recovery’ companies. As long-term investors, we need to look beyond these short-term shifts in markets to the true outlook for individual companies.

We have been both beneficiaries and victims of these market shifts. The focus on quality companies at Murray Income meant that the Trust proved resilient during the worst pandemic sell-offs, but it also meant that we lagged the sharp rally in November 2020. The same has been true for the income profile of the Trust.

In general, the companies we hold continued to pay dividends throughout the crisis, in contrast to the wider market, which of course means that they haven’t participated to the same extent in the subsequent partial recovery.

As such, investors in the Trust have avoided the whipsaw of investment markets over the past 12 months. This is deliberate; one of our key aims on the Trust is to be ‘dependable’ – we aim to deliver consistent capital returns and income. This is why we focus on higher quality companies. While weaker companies may have short-term periods of share price growth, good quality companies are best placed to grow their earnings sustainably over time.

Perhaps more importantly, the market tends to underestimate the durability of returns from this type of business. Earnings streams are less volatile and stronger balance sheets allow companies to navigate tougher times more successfully. We have seen this through the pandemic.

How we assess quality

When assessing quality, we consider five attributes – the sustainability of a company’s business model, its financial strength, the capability and skill of the management team, the attractiveness of the industry in which it operates and an assessment of environmental, social and governance (ESG) risks and opportunities. We want to find companies that manage both risks and opportunities successfully.

Our focus on environmental, social and governance factors is part of this quality assessment. A company cannot be high quality if it neglects its environmental impact, for example, or mistreats its employees. We have an on-desk ESG specialist and an internal ESG team, whose research is available to all analysts in the company and is a fundamental part of our decision-making.

Diversification is integral to avoiding the worst of market volatility. The pandemic has shown how problems can emerge unexpectedly and hit previously rock-solid industries.

As such, it is important not to put all our eggs in one basket. This is also vital when generating income. At Murray Income Trust, we look to diversify across the UK market – from larger to medium-sized companies.

We can add up to 20% in overseas listings, which brings in new sectors and ideas that may be underrepresented in the UK market. These factors – a focus on high quality, diversification, ESG and this overseas exposure - help to differentiate the Trust from its peers.

The equity income sector

This approach has helped us navigate a challenging time for the equity income sector in recent years. Dividends from companies held in the Trust have been very resilient and we believe the equity income sector is generally in better health post-pandemic. Companies that were previously over-distributing have pared dividends back to more realistic levels and earnings are encouraging.

While the past few years have been tough, it is important to remember that academic evidence shows that over the long-term, a significant part of stock market returns come from dividends and their re-investment.

Our priority is to find those companies growing their earnings and dividends over the long-term. In an ever-changing world, the market is likely to prize companies with strong business models and structural growth.

The UK equity market still has a valuation advantage over many of its peers. It may have recovered somewhat since the Brexit deal, but it has lagged for several years and international investors are still only lightly invested in the UK. This should change as Brexit is increasingly in the rear view mirror and corporate earnings improve. There is still considerable scope for a bounce-back trade in the UK. At Murray Income Trust, we are positioning to benefit from that.

Murray Income Trust is now in its 47th year of consecutive dividend increases to shareholders. 2020 was certainly among the toughest, but we see many reasons to be optimistic about the year ahead.

Important information

Risk factors you should consider prior to investing:

- The value of investments and the income from them can fall and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- The Company may charge expenses to capital which may erode the capital value of the investment.

- Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid-offer spread. If trading volumes fall, the bid-offer spread can widen.

- Certain trusts may seek to invest in higher yielding securities such as bonds, which are subject to credit risk, market price risk and interest rate risk. Unlike income from a single bond, the level of income from an investment trust is not fixed and may fluctuate.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

Other important information:

Issued by Aberdeen Asset Managers Limited which is authorised and regulated by the Financial Conduct Authority in the United Kingdom. Registered Office: 10 Queen’s Terrace, Aberdeen AB10 1XL. Registered in Scotland No. 108419. An investment trust should be considered only as part of a balanced portfolio. Under no circumstances should this information be considered as an offer or solicitation to deal in investments.

GB-230721-153655-1

Find out more at www.murray-income.co.uk or by registering for updates. You can also follow us on social media: Twitter and LinkedIn.

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.