Can private equity thrive in the ‘new normal’?

- Private equity has thrived since the Global Financial Crisis

- After declines in March, private equity valuations have recovered

- Private equity companies have proved resilient

By Alan Gauld, Investment Manager

Standard Life Private Equity Trust plc

This has been a golden decade for private equity. The financial conditions following 2008’s Global Financial Crisis were ideal for the asset class to flourish, with interest rates low and plenty of capital looking for higher growth assets. The question today is whether private equity can continue to thrive in the ‘new normal’ that emerges from the Covid-19 crisis?

Over the past decade, private equity has seen a virtuous circle. Returns have been strong, encouraging new capital into the sector, which has allowed good companies to stay private for longer. While companies might have previously listed at an enterprise value of around $500m (e.g. Amazon), today, they have been able to raise the money to grow while remaining in private equity hands (e.g. Airbnb).

However, today, investors are questioning whether returns can be sustained at the levels we've seen for the last 10 years. Investors have assumed that this crisis will see private equity valuations weaken, as they did during the financial crisis. There have been media reports of some problems at private equity-owned companies, particularly in ‘at risk’ sectors such as leisure and travel.

Certainly, we saw a large decrease in valuations in March. Private equity companies will use public market valuations as a benchmark, so it was inevitable that the weakness in the major stock markets around the globe had an impact in the private equity sector. However, as valuation figures have come through over the summer, we have seen a significant uptick that almost fully offsets the drop in March.

Resilience in challenging conditions

Undoubtedly, there are still companies in there that are struggling, but the number of companies that have proved extremely resilient in challenging conditions is perhaps the greater surprise.

Part of this resilience was that private equity managers had recognised in advance that the market environment was likely to change. They knew this was the longest bull market they had seen and, in many cases, had prepared their portfolios.

They were increasingly investing in resilient sectors such as technology, healthcare and consumer staples. For the Standard Life Private Equity Trust, these sectors now represent around half of its net asset value (NAV).

Where private equity managers are invested in more cyclical sectors such as industrials, or consumer discretionary, they are focused on specialist areas.

Typically, digitalisation and the shift to online is a big part of the investment thesis. The Trust is an investor in Photobox, for example. While this is ostensibly a consumer discretionary company and should be vulnerable to weaker economic conditions, it has proved resilient in this crisis. People took the opportunity of lockdown to organise the photos on their phone, creating new albums and the company has posted record numbers.

Similarly, Dr Martens, the footwear brand, initially appeared to be vulnerable because of the closure of its physical stores during lockdown, but its online channel has almost completely offset lost physical sales.

Allegro, the Polish online marketplace, has also traded at record levels during 2020 and recently successfully listed on the Warsaw Stock Exchange during the second half of year.

Weathering the storm

Merger, acquisition and Initial Public Offering (IPO) activity hasn’t dried up as would be expected. Firms still have a lot of ‘dry powder’ - capital available to deploy – and a limited time frame to use it.

As such, we have seen private equity firms continuing to sell to other private equity firms. Undoubtedly, there have been difficulties where it has been impossible to meet face to face, but it is not as bad as might have been anticipated in March.

To our mind, companies seem to be generally weathering the storm. Where businesses have experienced disruption to their business model, many have managed to cut costs, furlough staff, and raise additional capital.

We estimate that only 9 of the Trust’s top 100 underlying companies by value have seen a severe negative impact from the pandemic and are likely to experience debt covenant and liquidity issues.

The remaining 91 companies having only seen a temporary negative impact at worst, with several actually benefitting from current situation.

Looking at the Trust’s performance, we saw the NAV drop in March, but at less than half the fall of wider equity markets. By June it had recovered almost all that loss (on a constant currency basis). It has undoubtedly been volatile, but the swing in public markets was far greater. Historical analysis shows that private equity has a lower-than-expected correlation with comparable listed markets and so we believe that it has diversification benefits in an overall portfolio.

New firepower

While we have made some small adjustments to the portfolio, we are happy with the way it looks today. We recently extended the size of the Trust’s debt facility by £100 million, which gives us more firepower to deploy into new investments.

We believe there may be some distressed sellers, particularly in the secondary market, so this cash can be used to pick up positions more cheaply.

In spite of some gloomy predictions at the outset of the pandemic, private equity has shown its resilience in the face of a challenging environment.

To our mind, this reflects the changes seen in the sector over the past decade – including a focus on more resilient sectors and a greater operational involvement in underlying companies, including an increased focus on digitalisation and environmental, social and governance factors. We believe that private equity will continue to build from here as we move into the ‘new normal’.

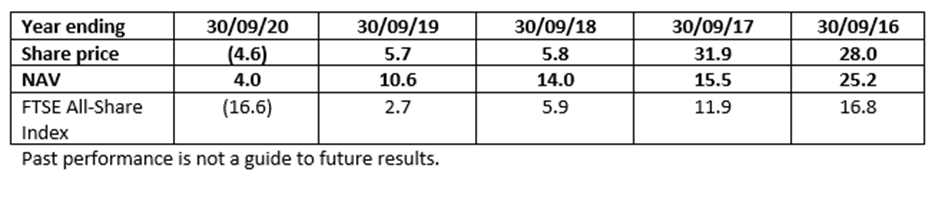

Discrete performance (%)

Important information

- The value of investments and the income from them can fall and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- The Company may charge expenses to capital which may erode the capital value of the investment.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid-offer spread. If trading volumes fall, the bid-offer spread can widen.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

- Certain trusts treat the generation of income as a higher priority than capital growth; such trusts may deduct part or all of their management charge from capital. This will increase the amount of income available but at the expense of capital growth.

- Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of your investment.

- Specialist trusts which invest in small markets or sectors of industry are likely to be more volatile than more diversified trusts.

- The Company’s investments may include unquoted and/or private equity investments which are not publicly traded or freely marketable and may therefore prove difficult to redeem. In addition, the potential volatility of investments in unquoted securities may increase the risk to the value of the investment.

Other important information:

Issued by Aberdeen Asset Managers Limited which is authorised and regulated by the Financial Conduct Authority in the United Kingdom. Registered Office: 10 Queen’s Terrace, Aberdeen AB10 1XL. Registered in Scotland No. 108419. An investment trust should be considered only as part of a balanced portfolio. Under no circumstances should this information be considered as an offer or solicitation to deal in investments. You should obtain specific professional advice before making any investment decision.

GB-201020-131822-2

Find out more at www.slpet.co.uk and register for updates here.

Follow us on social media here: Twitter or LinkedIn.

To buy this trust login to your EQi account

Select Standard Life Private Equity Trust - GB0030474687

Click to visit:

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.