Bouncing back to rude health

IBT is well positioned to exploit the attractive valuations on offer in the biotech sector...by Jo Groves

Investing in cyclical sectors can make for a white-knuckle ride on occasions but can also reward patient investors with significant gains over the longer-term. Indeed, investors in the biotech sector keeping the faith through its post-pandemic downturn have enjoyed a 25% rise in the Nasdaq Biotechnology Index (NBI) over the last four months, which may well signal the green shoots of a sustained resurgence in the sector.

At the outset, we should distinguish between sector fundamentals and investor sentiment. The sector fundamentals have remained strong, thanks to a number of secular growth drivers.

One such driver is the demographic timebomb of an ageing population, with the number of over-65s forecast to increase by 150% to hit 2 billion by 2067, according to the UN. Add in the growing prevalence of chronic diseases and the burgeoning middle class in emerging economies and it comes as little surprise that global healthcare expenditure is set to soar over the coming decades.

The biotech sector is also at the forefront of new treatments, harnessing the power of technology in the development of ever more effective and individualised therapies, including previously untreatable diseases. According to healthcare consultancy IQVIA, the biotech sector currently accounts for 80% of drugs in the development pipeline and large pharma companies continue to rely on smaller biotech companies to plug patent expiries in their product suite, prompting a record high in M&A.

Attractive valuations

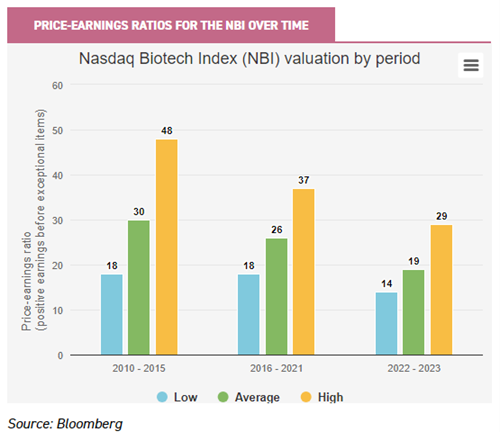

Despite its recent bounce, the sector is still trading well below long-term average valuations, as shown in the chart below. The average price-earnings ratio for the last two calendar years was 19, compared to an average of 26 and 30 for the 2010-2015 and 2016-2021 periods respectively.

The biotech sector is also trading at a lower valuation than the wider S&P 500 Index, despite typifying the innovative, high-growth attributes that have fuelled the outperformance of many of the tech companies over the last year.

The S&P 500 Biotech sector is currently trading at a price-earnings ratio of 17.0 compared to 20.6 for the S&P 500 (as at 04/03/2024), yet both have similar forecast earnings growth of around 9% in 2024, according to Yardeni. Looking at metrics like enterprise value/peak sales, which are more appropriate for companies that don’t yet have earnings (either because their drugs are not yet approved or they have a newly approved drug which does not yet make a profit), there is still a substantial number of biotech companies which are trading at a value lower than the value of the cash they hold in the bank.

This prompts the question: what factors have been weighing on biotech valuations? It’s worth saying at the outset that the heady valuations seen during the biotech sector’s glory days in the pandemic were arguably a mixed blessing. The indiscriminate flow of passive money propped up the weaker companies and, as we discussed in a recent note, prompted a necessary consolidation and restructuring of the sector.

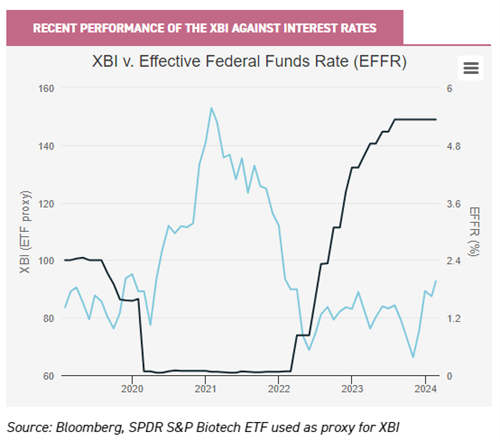

Macroeconomic challenges, and interest rates in particular, have undoubtedly proved one of the strongest headwinds for the biotech sector. Debt financing has become more expensive for biotech companies and higher interest rates have increased the appeal of lower-risk assets for investors. This inverse relationship between the biotech sector and interest rates is shown in the graph below, with the smaller-cap XBI biotech index rising during the period of ultra-low rates and falling ahead of the base rate hikes in early 2022.

Volatile stock markets and geopolitical issues have also prompted a risk-off period for investors, which has hit the more speculative biotech sector particularly hard. Investor nervousness has heightened sensitivity to adverse news flow, such as clinical trial data, and has underpinned a tendency to overlook more positive developments, leading to a growing divergence between valuations and sector fundamentals.

Positioning for the upturn

None of this will come as any surprise to seasoned biotech investors as biotech is, after all, a cyclical investment sector. And it’s a cycle that Ailsa Craig and Marek Poszepczynski, managers of International Biotechnology Trust (IBT), have seen repeatedly during their collective tenure of more than 25 years managing the trust. They divide the cycle into five stages, from despair, recovery and equilibrium to euphoria and correction.

One of the attributes of the recovery phase is an increasing level of M&A activity as large, cash-rich pharma companies take advantage of depressed valuations to supplement their product portfolios. This trend has been evident over the last year, with EY reporting that life sciences M&A soared to more than $190 billion in 2023, a year-on-year increase of more than a third, with the pharma mega-caps accounting for almost 70% of deals by value. The biopharma industry is holding near-record levels of financial firepower for acquisitions and M&A is likely to remain a key source of alpha generation for biotech funds.

The uptick in equity financing in 2024 so far has led Ailsa and Marek to regard the sector as just having entered the equilibrium stage, where an improvement in investor appetite helps to drive a re-rating in valuations, supported by positive stock market performance. Fears of ‘higher for longer’ interest rates have also been tempered by optimism that falling inflation may give the Fed the wiggle-room to cut interest rates in the coming months, which could support an uptick in valuations.

However, one of the key benefits of active management is the ability to tailor the portfolio according to the particular stage of the cycle. Ailsa and Marek seek to manage this cyclical volatility by tilting the portfolio towards more stable, established companies when valuations overheat and into higher-beta younger companies when valuations look more attractive. As a result, they have re-invested recent proceeds from M&A into smaller, development-stage companies to capture this potential upside opportunity.

In addition, IBT seeks to manage downside risk and preserve capital by investing in a basket of companies targeting the same therapeutic area and avoiding undifferentiated ‘me too’ drugs. The managers also reduce the trust’s exposure ahead of binary events such as the results of clinical trials.

This approach has paid off, with IBT achieving a net asset value total return of 43% over the last five years (as at 04/03/2024), which is an impressive achievement given the challenging conditions. This also shows the merit of active management by sector experts, with IBT comfortably beating the equivalent 34% return for the fund’s benchmark, the Nasdaq Biotechnology Index. IBT also pays a dividend set at 4% of the closing NAV for each financial year, which, at the current share price, is equivalent to a yield of 4.2% for income-seeking investors, one of the highest in the AIC Biotechnology and Healthcare sector (as at 04/03/2024).

Looking ahead, the biotech sector is likely to benefit from structural trends that should drive significant growth for years to come, although investors should be prepared for some cyclical volatility along the way. However, this is a sector where inexperienced investors may struggle to identify the likely winners and the specialist knowledge of experienced managers, such as IBT, can make a significant difference to long-term outperformance.

View the latest research note here >

Placeholder for IBTI ‘Themes for your ISA 2024’ video filmed 19/3

Disclaimer

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by International Biotechnology. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.