Best of both worlds

How JPMorgan Global Growth & Income Investment Trust seeks to pick winners and deliver the best of both income and capital

Yield is hard to find in today’s market, yet JP Morgan Global Growth & Income aims to deliver both dependable income and capital growth to its investors. The secret lies in the distinctive way it goes about selecting stocks across the globe.

Local presence

How would you go about assessing a company as an investment prospect? Its website would be an obvious place to start, as well as trade news coverage. If you had the advantage of personal contacts, you might also get the chance to visit and hear the directors’ case at first hand. But even that would only scrape the surface, according to Tim Woodhouse, portfolio manager at JP Morgan Global Growth & Income (JGGI).

“It’s not just about meeting the company leaders. It’s also about doing things like factory visits and going into stores,” says Woodhouse. “There’s a lot of research which is not just reading an annual report and listening to a presentation from the management team. That’s why our local presence in regions across the world is incredibly important.”

JPMorgan puts significant resources behind that presence. Its 350-strong equity investment team includes over 80 research analysts, backed up by an annual research budget of $150m. It’s these local experts, covering 2,500 companies, who deliver the insights that inform the fund’s choice of stocks – a truly ‘bottom-up’ approach to selection.

Freedom to choose

Marrying that global reach and local expertise ensures the fund is truly diversified. A further liberating factor is that it’s not bound by the need to pick quotas according to sector or region. “We don’t want to make our money by saying we’ll have a much larger percentage of portfolio in the US, or in Europe,” Woodhouse says. “The nice thing is, we don’t have to: we can find the most compelling individual stock ideas from all regions.”

This flexibility allows the huge advantage of being able to compare stocks directly across different regions. Woodhouse cites Japan’s Daikin and Trane in the US, both in the air conditioning sector. “We can assess the growth prospects and cash flow estimates for the next decade, then ask, do we want to own either of these? Which one? Sometimes both will offer a compelling proposition, because of a strongly growing market.”

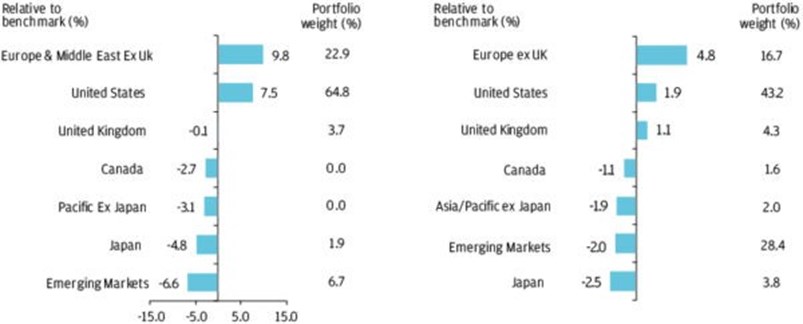

Exhibit A: Regional & Country Positions – based on company listing (left) and based on underlying company revenues (right)

Source: J.P.Morgan Asset Management. Factset. Positioning excludes effects of gearing. Underlying company revenue exposure is estimated based on disclosed data. Holdings, sector weights, allocation and leverage, as applicable, are subject to change at the discretion of the investment manager without notice.

Taking the long view

JGGI’s analysis focuses firmly on long-term prospects, an approach exemplified by its choice of the ride-hailing firm, Lyft. While the start of pandemic lockdowns seemed at face value to spell gloom for the company, JGGI calculated that the firm’s balance sheet meant it could emerge with a healthy fund even if its revenues plunged by 60% over two years. Its likely role in implementing the future of autonomous driving services was further evidence to stick with Lyft.

Our research on structural change drives differentiated investment insights

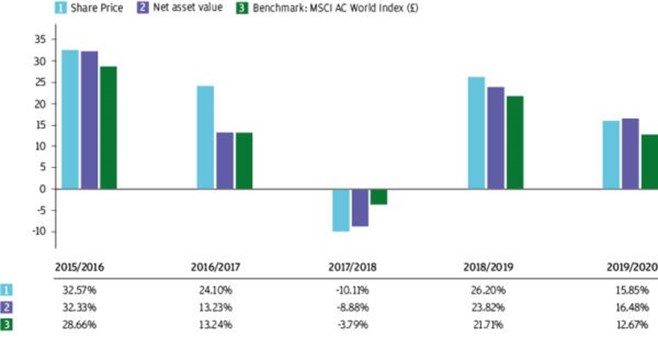

By focusing on that kind of structural change, rather than short-term cycles, JGGI has found value. The fund’s returns over both the long and short term have consistently outperformed those of MSCI’s global equity index and the UK market. Performance is 1.7% ahead of the MSCI All Country World Index benchmark since the fund’s inception 24 years ago. And investors now benefit from JGGI’s dividend policy, introduced in 2016, which pays at least 4% of the net asset value.

Quarterly Rolling 12-month performance (%)

As at end of December 2020

Enviable yield

In part, JGGI is able to make this commitment because as an investment trust, it is able to hold capital reserves. It also has the freedom to borrow money to buy assets, known as gearing – providing the means to buy attractive stocks without the need to sell existing assets.

“The 4% dividend we pay each year is made up roughly 50% from the yield of the underlying stocks in the portfolio, and 50% from our capital reserves,” Woodhouse explains. “That’s a sustainable model, allowing the capital to grow.”

A yield of that margin from stocks alone in the current market would be risky at the very least: “The market would have some scepticism about the sustainability of any stock that is yielding above 4%,” Woodhouse observes. “Yield is not easy to find in the world today – so I believe a 4% yield is a very good proposition for our shareholders.”

Investors who are on the lookout for a reliable income, but also keen to benefit from capital growth, could discover the best of both worlds in JGGI’s truly diversified portfolio.

Risk Profile

- Exchange rate changes may cause the value of underlying overseas investments to go down as well as up.

- Investments in emerging markets may involve a higher element of risk due to political and economic instability and underdeveloped markets and systems. Shares may also be traded less frequently than those on established markets. This means that there may be difficulty in both buying and selling shares and individual share prices may be subject to short-term price fluctuations.

- Where permitted, a Company may invest in other Investment Funds that utilise gearing (borrowing) which will exaggerate market movements both up and down.

- This Company may use derivatives for investment purposes or for efficient portfolio management.

- External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds and income could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions.

- This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down.

- This Company may also invest in smaller companies which may increase its risk profile.

- The share price may trade at a discount to the Net Asset Value of the Company.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of The warning in brackets must be removed if the Marketing Communication has been released for General Public.

Financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained free of charge from JPMorgan Funds Limited or www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

Read the latest edition of DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.