An unreasonable discount?

Shares in Invesco Perpetual UK Smaller Companies Investment Trust plc are trading at 17% below their net asset value…by David Kimberley

At the end of September, the UK MSCI Index was trading at a 36.2% discount to the MSCI World Index on a forward price-to-earnings (P/E) basis – a metric that compares how a company’s shares are priced relative to their profitability.

This is not a novel phenomenon. Since the Brexit vote in 2016, the UK market has seen a steady decline in its average forward P/E valuation relative to the global mean.

Indeed, UK stocks are substantially ‘cheaper’ than not just their US, European, and Japanese peers, but even the MSCI Emerging Markets Index.

Prospective investors may be tempted to dismiss the UK as a value trap on the back of this. It’s a cheap market for a reason, the logic would go, and so buying is akin to leaping on board a sinking ship in the hope it will somehow manage to resurface.

That may sound sensible but it’s not a particularly nuanced take. For one thing, performance has diverged across the market cap spectrum and even though the UK market as a whole has performed sluggishly over the past decade, some active managers, particularly in the small-cap space, have managed to deliver very strong performance for their investors.

Another positive sign is the level of acquisition activity we’ve seen in the market over the past 18 months. From the start of this year until the end of July, 25 takeover deals involving London-listed firms had either been completed or were pending.

This was higher than the 18 equivalent deals which had taken place in the same period in 2021 – remarkable given how chaotic 2022 has been and how high the levels of merger and acquisition activity were last year. More importantly, it suggests that plenty of private equity funds and corporates believe the UK market is undervalued.

Nonetheless, valuations remain low and in the investment trust sector we’ve also seen discounts widen substantially this year, particularly in the small-cap space. As the Kepler Trust Intelligence analyst team noted in August, discounts in the AIC’s UK Smaller Companies sector had, taking 28 July as the end point, widened to one standard deviation below their five-year historical average.

Invesco Perpetual UK Smaller Companies (IPU) has been affected by this dynamic. On 06 October 2022, the trust’s discount stood at just over 16% – far wider than its five-year historical average of 8.2%.

Like its peers, IPU has likely been hit harder than some large cap-focused funds because of fears about inflation and concerns about how capable the firms in its portfolio will be of dealing with price pressures.

But as the discount shows, these sell offs have been dramatic and, chaotic as things may be, it makes you wonder what the market is attempting to price in at this point.

Moreover, trust managers Jonathan Brown and Robin West did not invest in the sort of zero-profit, early-stage small caps that saw massively inflated valuations during the pandemic. And even though they’re happy to buy higher priced shares, the managers are still very mindful of valuations and won’t pay up if the company doesn’t have the financials to justify doing so.

They’ve also always paid careful attention to quality characteristics and were making efforts to ensure their holdings could withstand inflationary pressures long before fears about currency devaluations started to seep into the markets at the end of last year. Indeed, over the past couple of years, eight companies in IPU’s portfolio have been acquired, a sign that the managers do have the ability to spot undervalued companies with good future prospects.

These traits are clearly positive but the market seems to have largely ignored them. This shouldn’t be too surprising though. UK small caps have tended to be more volatile than their large peers in the past. Investors in the sector must be prepared to stomach these potential price swings as a result. But doing so has historically meant seeing substantial outperformance.

Even over the past decade, investment trusts in the AIC’s UK Smaller Companies sector have averaged higher total share price returns than any other UK-focused sector, including those that invest in real estate.

Looking further back, from the start of 1995 until the time of writing (6 October2022), which is the limit of the historical data available to us, the FTSE 100 saw a total return of 511.0% and IPU’s benchmark, the Numis Smaller Companies plus AIM (Ex. Investment Companies), produced total returns of 645.0%. Over the same period, IPU’s total share price returns were 1,607.4%.

Past performance doesn’t indicate what future returns are likely to be. However, for investors that are prepared to hold for the long term, IPU’s current price may be appealing – particularly for those who believe that the UK has been oversold and is undervalued as a result. On top of this, the trust’s wide discount could tighten if markets do rebound. Were that to happen then it’s possible investors could see an additional boost to capital, with the discount tightening on the back of strong performance.

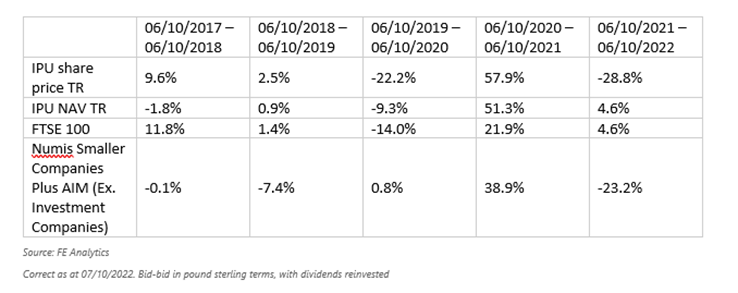

Standardised 12 month rolling performance (% growth)

Past performance does not predict future returns

Read the latest research on IPU >

This is a non-independent marketing communication commissioned by Invesco Perpetual UK Smaller Companies. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.