An introduction to socially responsible investing with ETFs

Can our portfolio choices do the power of good to the environment and society as well as our personal wealth? Those practicing Socially Responsible Investing (SRI) believe so…writes Christian Leeming.

If you like the idea of aligning your investments with your values then take a look at Socially Responsible Investing (SRI) ETFs.

SRI indices track firms that take a positive approach to environmental, social and corporate governance (ESG) issues. That can mean anything from firms producing green tech or actively managing their carbon footprint to favouring companies that promote ethical and sustainable business practices. SRI indices are also likely to exclude so-called sin stocks – firms up to their neck in the alcohol, tobacco, arms, gambling, pornography, fossil fuel and nuclear industries, among others.

Although SRI is a fast-growing sector, the idea of influencing society through investing is not new.

In good company

The Quakers are often credited as the original SRI investors after they forbade their members to profit from the slave trade in the 18th Century. Other religious organisations have worried about ill-gotten gains too and regularly used the pulpit to steer their flocks away from vice like liquor and guns.

The Anti-Apartheid movement further hastened the emergence of SRI. Strong financial players such as universities, cities, pension funds and faith-based institutions screened out South African companies from their portfolios in a bid to ratchet up political pressure on the regime.

The SRI sector has blossomed ever since as more funds arrived enabling investors to direct their cash towards green themes such as clean energy or water and, increasingly, towards broad-market SRI ETFs.

European investors poured a record-shattering €120 billion into sustainable investment options in 2019, Morningstar data reveals; European sustainable funds now hold a hefty €668 billion of assets, up 58% from 2018.

That number is only likely to increase as many market participants believe that ESG companies are best placed to meet the challenges of the future – think pension funds reducing their exposure to fossil fuel firms, for example.

There’s also evidence that millennials and women are increasingly interested in SRI too – a Morgan Stanley survey found that 70% of females and 84% of millennials believed that ESG factors were important.

SRI performance

But is SRI too good to be true? Do you have to compromise your principles for performance?

A number of studies have examined this question and concluded that SRI funds largely perform on a par with their conventional counterparts and can beat them.

How does good triumph over bad? Firms that are sensitive to ESG factors often operate more efficiently. That translates into better cashflows, a lower cost of capital and ultimately superior performance. Such companies are also better positioned to take advantage of the opportunities afforded by sustainable business practices

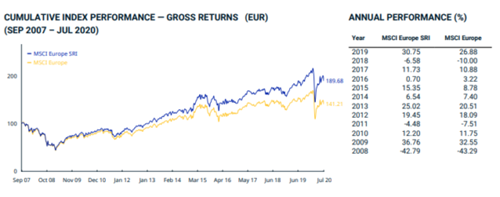

MSCI Europe SRI vs MSCI Europe

In the example above, you can see that MSCI Europe SRI has consistently outperformed MSCI Europe over the last decade; it turns out that socially responsible investments can be easy on your conscience and your portfolio.

How do SRI indices work?

SRI indices vary so it’s important to make sure that your chosen ETF tracks one that matches your concerns.

Often an SRI index starts as a clone of a well-known parent index such as MSCI World. Firms that cross the index’s red lines are shunned. iShares MSCI World SRI knocks out companies with their fingers in the following pies:

· Alcohol

· Gambling

· Tobacco

· Military weaponry

· Civilian firearms

· Adult entertainment

· Genetically modified organisms

Many companies are conglomerates so they will be red carded if their sin revenues top a certain size or if they’re fundamentally involved as a producer, supplier or distributor.

Some indices will then upweight virtuous equities that score highly against ESG criteria such as strong environmental practices, respect for human rights and positive employee relations.

The screening process means that an SRI index is likely to be more concentrated than its amoral parent – MSCI Europe has 446 constituents versus 113 for MSCI Europe SRI.

But some indices will compensate by retaining their parent’s regional and risk-return characteristics.

SRI ETF selection

Naturally choice is the winner as the popularity of SRI ETFs grows. You can responsibly invest in a global SRI ETF; across regions like the Emerging Markets; within single countries, or sustainable industries such as clean energy. You can invest according to religious principles too, as in iShares MSCI World Islamic ETF.

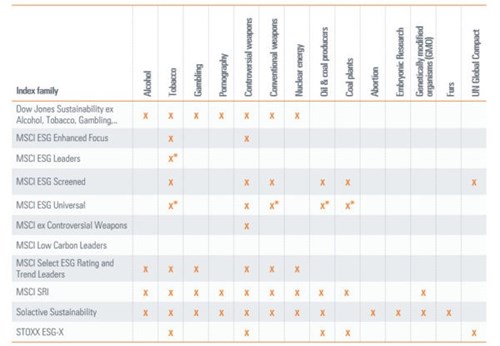

As you probably suspect already, MSCI is the dominant index family in SRI investing, although others exist too, each with their own moral code:

Moral focus of SRI indices

Source: justETF.com; Research

The other thing to know before you go off to polish your halo is that many SRI ETFs have a relatively small amount of assets under management. ETFs that fail to grow in size run the risk of being closed by their providers which could leave you sitting out of the market until you’re able to redeploy your cash.

Green bond ETFs

In addition to the now established sustainable equity ETFs, an increasing number of green bond ETFs are entering the market. As with equity ETFs, the companies and partly sovereigns behind the financial instrument are reviewed, selected or excluded on the basis of sustainability criteria.

The methodology is similar to the one used for evaluating equity issuers. MSCI, the market leader for equity indices, cooperates with Bloomberg Barclays, a well-known provider of bond indices.

To find ETFs use EQi’s search facility

To learn more about socially responsible investing see Ethical Investing Insights or visit DIY Investor

EQi's fund lists

Use our fund lists to find funds based on insight and ratings from Square Mile, one of the largest and most respected investment research teams in the UK. Our lists are a great way to narrow down your choice before you select which fund best suits your investment goals.