A trust with hidden depths

Disclosure – Non-Independent Marketing Communication. This is a non-independent marketing communication commissioned by Seneca Global Income & Growth. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

We take a look at SIGT, a multi-asset trust offering a solid income from a truly diversified portfolio…

Seneca Global Income & Growth (SIGT) is a broadly diversified multi-asset investment trust which, in the manager’s words, pursues a ‘redefined approach to value investing’.

As the evidence of a shift in favour of value stocks continues to mount – after a strong rally for value in the latter part of 2020 – the focus for many is likely to be on the potential for rising share prices among value stocks if that rally continues.

Capital growth is only one side of the coin, however. SIGT aims to achieve total returns of at least CPI +6% p.a. net of costs over a typical investment cycle, and offers a yield of around 4% – which is comparable with the UK and Global Equity Income sectors.

Given the diverse multi-asset approach that SIGT employs, and the diversification this means it is able to offer investors as a source of income, this attractive yield is in our view worth much closer attention at a time when traditional sources of income for UK investors – who are in many cases overexposed to UK equity income – face a challenging outlook…

A drought for some, a deluge for others…

According to research from GraniteShares, close to 500 companies listed on the London Stock Exchange had cancelled, cut, or suspended dividend payments in 2020 by the end of November.

This was across every market cap with none of the FTSE indices showing immunity; with 51 FTSE 100 companies, 115 FTSE 250 companies, and 149 AIM-listed companies reporting impairments to distributions.

In comparison to the three previous years, 2020 UK dividend payments hit record lows, leaving income reliant investors in a vulnerable position.

The weakness of dividends in some equity companies underlines the benefits of a more diverse approach to generating income and in our view SIGT sits well against that backdrop.

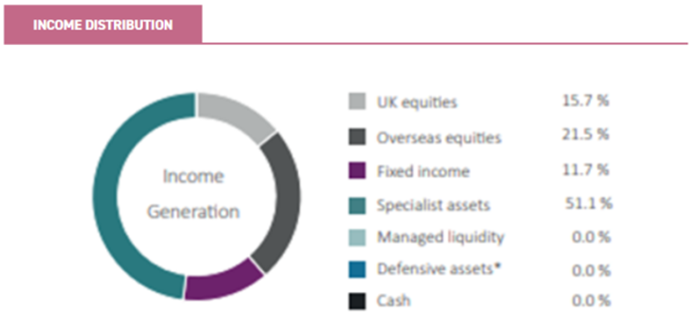

Currently SIGT yields 4% and has been able to grow its dividend at a rate of 3.5%, maintaining the dividend levels in the first two interim payments in the current financial year (2021). The income has been generated across a diverse mix of asset classes, with areas like specialist assets and fixed income supporting the weaker-than-usual contribution from equities.

Source: Seneca

Source: Seneca

Within the specialist assets class, companies like RM Secured Direct Lending (RMDL) and AEW UK REIT (AEWU) have maintained high levels of income despite the difficult market and economic conditions.

RMDL focuses on complex smaller short duration loans which sit outside the lending criteria of larger banks and has demonstrated underlying portfolio resilience through high interest rates and low LTVs, while maintaining their dividend over the year.

Since the vaccination announcements, the company has seen a growing NAV and a shrinking discount, whilst yielding 7.5% at the current share price. AEWU, a property investment trust, on the other hand has sat in a difficult sector during the pandemic but, according to the managers at SIGT, has handled the challenges well.

The underlying assets have seen strong rent collection during 2020 and limited rent reductions. AEWU is run by a highly active manager who looks to develop assets and sell them following a strong uplift in valuations.

Despite the pandemic, this has continued throughout 2020 and has supported the current yield of 10%.

Both RMDL and AEWU are good examples of SIGT’s value focussed stock selection process in action. SIGT’s managers were able to identify that market concerns over the sustainability of both the headline dividend and the underlying income generation in these holdings, was likely overly negative considering the long-term outlook.

As news flow turned increasingly positive for these assets, the market has sharply readjusted its expectations.

Whilst AEWU, for example, undoubtedly retains some sensitivity to the broader macroeconomic picture in terms of its ability to generate income, other holdings in the specialist assets portfolio, such as Hipgnosis Songs (SONG) have displayed little NAV sensitivity to ongoing economic developments. The income streams they generate have proven highly resilient.

As well as using income from the underlying companies to pay dividends to shareholders, the structural advantages that investment trusts have mean the board are able to utilise their revenue reserves; money which is effectively put aside when the pickings are rich to support dividends during leaner years, something which open-ended funds cannot legally do.

The most recent full year dividend of the trust was covered 0.6x by revenue reserves at the last interim review, though there have been subsequent distributions (and income receipts).

The board also has the ability to utilise SIGT’s special reserve and realised capital reserve to support the level of dividend distributions if necessary, and has voiced their intention at the very least maintaining the current level of dividend.

The board of SIGT run a strict discount policy, and currently SIGT is trading at a discount of 2.7%, although the trust has previously traded at a premium.

Although longer term performance has been subdued in the face of a challenging market for value investors, the performance of the trust over the past six months, to 18/01/2021, has been strong relative to the benchmark (as discussed in more detail here), and also in comparison to both the FTSE All-Share and MSCI ACWI indices. We note that this has also been achieved with lower volatility than the FTSE All-Share.

Given the dependable and competitive yield of the trust, the diversified nature of the assets behind that income, the growing view among investors that value may finally be coming back into fashion, and the potential for continued NAV growth should that trend continue, this is an interesting time for investors in SIGT.

To read more about the unique and highly differentiated approach of SIGT, click here…

Click to visit:

Disclaimer

This report has been issued by Kepler Partners LLP. The analyst who has prepared this report is aware that Kepler Partners LLP has a relationship with the company covered in this report and/or a conflict of interest which may impair the objectivity of the research.

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that if you are a private investor independent financial advice should be taken before making any investment or financial decision.

Kepler Partners is not authorised to make recommendations to retail clients. This report has been issued by Kepler Partners LLP, is based on factual information only, is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Click to visit:

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.