A differentiated approach to building long-term value

Disclaimer

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by NB Private Equity Partners. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

A differentiated approach to building long-term value

When it comes to choosing a private equity manager, it is vital to choose carefully...

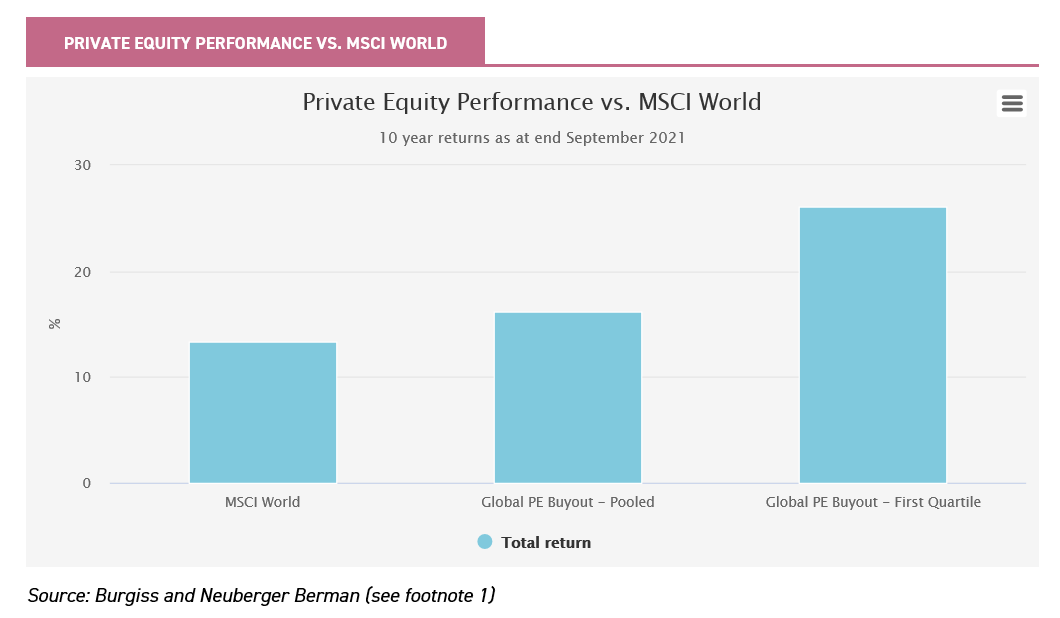

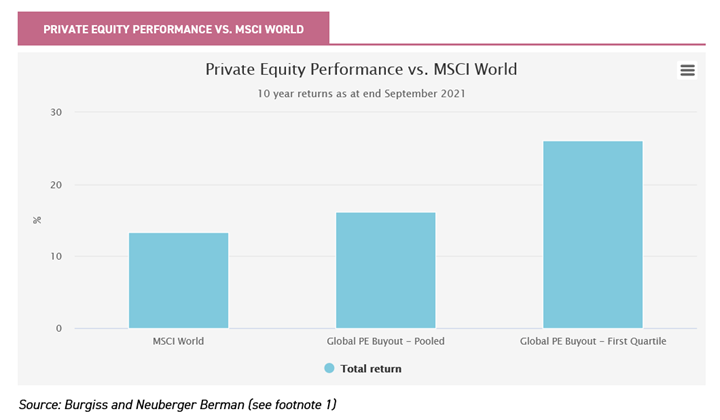

The benefits of private equity’s hands-on active ownership model and long-term investment horizon have helped to drive an outperformance of returns versus public markets over multiple investment cycles.

As owners rather than minority shareholders, private equity managers can drive strategy and change in a company. Control is crucial. Away from the glare of the public markets and its focus on shorter term earnings, private equity managers can build long term value. With inflation reaching its highest level in 30 years coupled with volatile stock markets, the ability to continue to generate this long-term value may depend even more on sustainable revenue and earnings growth, which can be driven by the value which a private equity manager can bring to the companies they own.

Choose carefully

But investors need to be selective. The difference between top quartile and median performance in private equity can be significant. Manager and investment selection is critical, especially in more challenging environments.

NB Private Equity Partners’ (NBPE) manager, Neuberger Berman, has been investing in private equity for over 30 years with a track record of generating value over the long-term. The Neuberger Berman team has active investments with over 2752 high-quality lead private equity managers and reviews hundreds of investment opportunities every year. This gives it a deep and wide understanding of the private markets, and thereby greater potential to select investments alongside top quartile managers and capture their outperformance.

Be appropriately diversified and nimble

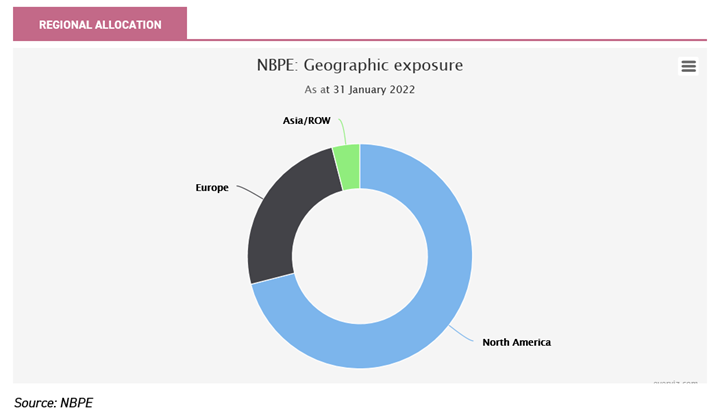

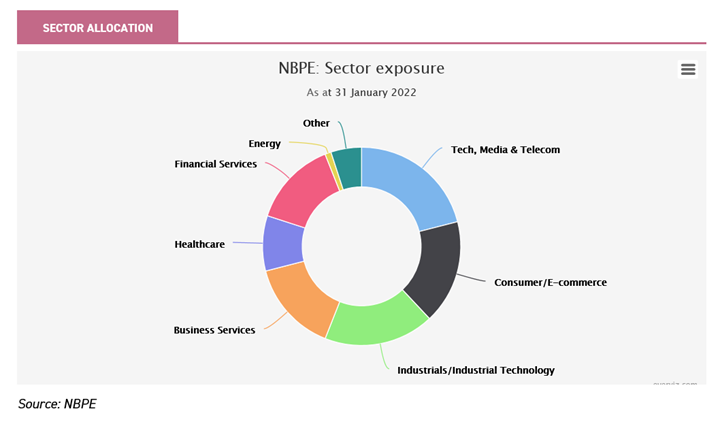

Unlike many listed private equity vehicles, which typically invest with a single manager or via a fund of funds model, NBPE is focused on co-investing. Investing directly into private companies alongside multiple high-quality private equity managers, NBPE aims to combine the best of both models, offering manager, strategy, sector and geographical diversification. At the same time, this approach makes portfolio composition and value drivers easier to understand and is more fee efficient. Most co-investments Neuberger Berman completes do not incur additional management or performance fees paid to underlying managers3. By investing directly, on a deal-by-deal basis, NBPE can be nimble. It can speed up or slow down the pace of investment depending on market conditions and the fund’s capital structure needs.

Build strong partnerships

Partnership is crucial, both for access to investment opportunities as well as the ability to choose the best managers to work alongside. The co-investment strategy at Neuberger Berman focuses on partnering with the right private equity managers, with the right experience for the right opportunity.

The Neuberger Berman team targets managers who have demonstrated a proven track record of investment discipline, value creation and generating strong performance through changing investment environments.

As a co-investor, Neuberger Berman has built a bespoke portfolio of direct investments in private companies for NBPE by investing alongside such managers in their core area of expertise. This expertise can be related to a specific sector, or geography. Or it can be a proven ability and track record of investing in complex transactions, such as corporate carve outs, which involve buying a division from a larger business.

Prioritise resilience

The foundation of NBPE’s portfolio is investments in companies that benefit from long-term secular growth trends, or in businesses that are expected to be less cyclical.

The team looks for industry leaders – companies that have sustainable competitive advantages, with business models that are hard to replicate and high barriers to entry. Portfolio companies should have strong and proactive management teams with the resources and incentives to implement the changes necessary to create long-term value.

Look for multiple levers for growth

Neuberger Berman also aims to invest in opportunities where private equity managers can add real value. Examples of this include introducing new products or entering new markets or geographies, finding efficiencies, or optimising management teams and people, such as ramping up a sales force. Acquiring complementary businesses through M&A can capture synergies, increasing market share and overall scale, as well as the attractiveness to potential buyers.

Ensure prudent capital structures

It is imperative to get the financial fundamentals right – investing in companies with prudent capital structures is paramount. Companies should have the ability to support the investment thesis, without raising concerns about managing their debt.

Position the portfolio to perform

Successfully managing an investment portfolio involves analysing the prevailing and expected conditions, accounting for the risks, and positioning the portfolio to perform. This is the goal for NBPE’s portfolio and importantly it also means being well positioned to capitalise on new investment opportunities as they arise.

For NBPE, this strategy has produced strong returns. Over the last five years NAV has grown by 120%4 and companies have been sold for an average of 2.8x times their original cost over this time period. With $1.5 billion invested in 95 companies across a range of industries, we believe the portfolio is well positioned to continue to deliver growth and build on its strong performance.

Here is one of NBPE’s portfolio companies:

Constellation Automotive (formerly BCA), is a provider of vehicle remarketing services. TDR Capital, a leading European private equity manager focused on investing in market leading companies, acquired BCA Marketplace in a public to private transaction in 2019. At the time of the investment, BCA Marketplace was the largest B2B provider of vehicle remarketing through physical auctions. BCA had significant scale, data and technological know-how to source and provide the physical logistics for car auctions, serving as a strong core business platform for TDR’s acquisition. WeBuyAnyCar, the UK’s leading C2B online buying car platform owned by BCA Marketplace, was also acquired which further diversified sourcing channels.

Under TDR’s ownership, the company has focused on digitisation and technological transformation, moving from a physical auction marketplace to 100% digital auctions while also driving growth. Today, the company’s technological transformation has enabled it to become a comprehensive digital auction platform that allows large vendors including dealers, fleet managers and car rental companies to sell their stocks of used cars quickly and easily. Constellation Automotive then sells this stock of used cars directly to dealers through its BCA division and to consumers through Cinch, the B2C online used car marketplace, which raised over £1bn in May 2021 from new and 3rd party investors. Today, Cinch is now a UK household name. Finally, in October 2021, Constellation Automotive acquired CarNext, a leading B2B and B2C digital used car sales marketplace present across 22 European countries. This acquisition created Europe’s largest digital used car marketplace, selling more than 2.5 million cars annually for a gross merchandise value of €21 billion.

TDR’s acquisition and value creation strategies have completely repositioned the business and enabled the digital transformation of the company into a high growth platform with a fully integrated C2B / B2B / B2C marketplace. This transformation would have been difficult in the public markets outside the control of a private equity investor with the skills and expertise and long-term focus to drive such a change. NBPE co-invested $17 million in Constellation Automotive and at 31 January 2022, the holding was valued at $97 million, making it the largest portfolio company position in NBPE’s portfolio.

Important information

Past performance is not a reliable indicator of future returns. The value of investments and the income from them can go down as well as up, so you may get back less than you invest. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Overseas investments are subject to currency fluctuations. The shares of NBPE are listed on the London Stock Exchange and their price is affected by supply and demand and demand and the discount at which NBPE trades could vary significantly based on these factors. NBPE can gain additional exposure to the market, known as gearing, potentially increasing volatility. Investors should note that the views expressed may no longer be current and may have already been acted upon.

1 Source: For illustrative purposes only. The benchmark performance is presented for illustrative purposes only to show general trends in the market for the relevant periods shown. The investment objectives and strategies of the benchmarks may be different than the investment objectives and strategies of a particular private fund, and may have different risk and reward profiles. A variety of factors may cause this comparison to be an inaccurate benchmark for any particular type of fund and the benchmarks do not necessarily represent the actual investment strategy of a fund. It should not be assumed that any correlations to the benchmark based on historical returns would persist in the future. Past performance is no guarantee of future results. Indexes are unmanaged and are not available for direct investment. Source: Private equity data from Burgiss. Represents pooled horizon IRR and first quartile return for Global Private Equity as of September 30, 2021, which is the latest data available. Public market data sourced from Neuberger Berman.

2 As of September 30, 2021.

3 Approximately 97% of NBPE’s portfolio direct investments (measured on 31 January 2022 fair value) is on a no management fee, no performance fee basis to underlying third-party GPs

4 US$ Total Return at 31 January 2022

Disclaimer

This report has been issued by Kepler Partners LLP. The analyst who has prepared this report is aware that Kepler Partners LLP has a relationship with the company covered in this report and/or a conflict of interest which may impair the objectivity of the research.

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that if you are a private investor independent financial advice should be taken before making any investment or financial decision.

Kepler Partners is not authorised to make recommendations to retail clients. This report has been issued by Kepler Partners LLP, is based on factual information only, is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority (FRN 480590), registered in England and Wales at 70 Conduit Street , London W1S 2GF with registered number OC334771.

Read the latest edition of DIY Investor Magazine

DIY Investor Magazine

The views and opinions expressed by the author, DIY Investor Magazine or associated third parties may not necessarily represent views expressed or reflected by EQi.

The content in DIY Investor Magazine is non-partisan and we receive no commissions or incentives from anything featured in the magazine.

The value of investments can fall as well as rise and any income from them is not guaranteed and you may get back less than you invested. Past performance is not a guide to future performance.

DIY Investor Magazine delivers education and information, it does not offer advice. Copyright© DIY Investor (2016) Ltd, Registered in England and Wales. No. 9978366 Registered office: Mill Barn, Mill Lane, Chiddingstone, Kent TN8 7AA.