What you need to know about impact investing

Impact investing (so-called because the stocks and funds on offer have a positive impact on society, or the environment, or both) is fast gaining followers, not just for its morally virtuous stance, but also for its returns.

Fund managers have identified key long-term ‘mega trends’, structural shifts in sectors such as technology and energy, for example, which are expected to result in the world moving away from things like fossil fuel dependency and plastics, towards renewable energy and resource efficiency. Investing in these mega trends has the benefit of meeting global goals on poverty and sustainability, while making a profit.

However, for normal investors, navigating this uncharted and relatively small field, for the first time, can be tricky. How do you choose the right fund and know which ones are truly living up to their claims?

How do you choose the right fund and know which ones are truly living up to their claims?

An ‘impact’, ‘green’ or ‘sustainable’ label doesn’t necessarily guarantee that your money is contributing to really positive world-changing solutions, or to activities which align with your moral compass.

Top-rated impact funds, from 3D Investing, an independent research company specialising in the sector, tick the boxes for both high impact and financial performance. This means that you don't have to compromise on returns if you wish to make your money purposeful as well as profitable.

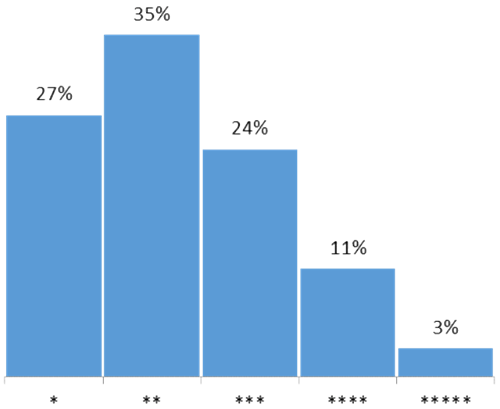

The 3D Star Rating (where 1 star is the lowest rating for impact and 5 is the highest) is intended to facilitate quick and easy identification of those funds which best meet the 3D Investing objectives of making a positive social impact, whilst avoiding ethically controversial companies and delivering a decent financial return.

Ratings for impact can differ when compared with Environmental, Social and Governance ratings, such as Morningstar’s, because the latter take into account governance matters such as reporting regularity.

John Fleetwood, of 3D Investing, says: “The 3D ratings look at the proportion of the portfolio invested in actual solutions to social and environmental challenges, the level of ethical controversy associated with the fund, the degree to which the fund meets financial expectations and the level of transparency and reporting. By way of contrast, Morningstar ratings are based on an Environmental and Social Governance assessment of underlying companies. This is principally concerned with how companies operate."

"For example, Shell gets a good ESG rating from Morningstar because it has good processes, but it's still an oil company with a negative environmental impact. By way of contrast, one of the holdings in the WHEB fund, Acuity Brands, makes LED lighting with a positive environmental impact. This gets a poor ESG rating because its processes aren't as good as companies like Shell.”

The 3D Star Rating is a demanding ranking that seeks to identify the very best funds. As such, a three-star rating is far from average and in fact means the fund is likely to be among the best in its sector. A five-star rating is reserved for the very best funds and is an aspirational standard.

What do the 3D ratings mean?

The fund is a real pioneer in the industry. It has delivered financial returns in line with expectations, excellent levels of transparency, a high social impact and is not exposed to ethically controversial companies.

The fund carries a high level of conviction for the same reasons as five star funds, but with a relative weakness in impact, transparency, or sustainability management.

The fund is positively rated where the advantages outweigh the disadvantages, and where the fund might be considered for inclusion in the 3D portfolio.

![]()

The fund may be worth considering, but there are significant weaknesses in terms of financial track record, social impact or avoidance of ethical controversy.

![]()

The fund is negatively rated because of major concerns over its financial track record or stock selection that fundamentally undermines our confidence in the fund.

The percentage of impact funds assessed with each star rating

Six impact funds rated highly by 3D Investing

5-star funds

FP WHEB Sustainability Fund

This fund is a multi-thematic, global listed equity fund that invests exclusively in companies providing solutions to sustainability challenges. It targets strong long-term growth and risk-adjusted returns.

Its top ten holdings include Stantec, one of the leading environmental services groups in North America with a focus on environmental design, water supply and waste water disposal, and CVS Health, a US-based company specialising in pharmacy benefit management services and retail clinics.

The fund returned 15.3 per cent in 2017 and 10.97 per cent annually over the last five years (to the end of February). It is a certified B Corporation and has committed to the Eurosif transparency code.

Impax Environmental Markets PLC

The objective of the fund is to enable investors to benefit from growth in the markets for cleaner or more efficient delivery of basic services of energy, water and waste. The companies the fund invests in mostly provide, use, implement or advise on technology-based systems, products or services in environmental markets, particularly alternative energy, energy efficiency, water treatment and pollution control.

The fund returned 18.68 per cent in 2017 and 15.91 per cent annualised over the last five years. Among its top holdings in that period were a Portuguese renewable energy developer, EDP Renovaveis SA, and Brambles Limited, an Australian waste technology specialist.

Foresight Solar Fund Limited

This £480m fund invests in ground-based, solar photovoltaic (PV) assets, to deliver “attractive, sustainable and inflation-linked dividends”, which it pays to investors quarterly. So unlike some of the other funds, the focus is not on capital growth, but income. It has 19 assets in the UK (mostly in the west and south west of England) and four in Australia.

The fund has paid a dividend of just over 6p in the £ every year since it was established in 2014. Its target dividend was 6.32p in 2017.

4 Star funds

Pictet Global Environmental Opportunities

The fund aims to grow capital by investing in shares and other equity-related securities issued by companies that are active along the “environmental value chain”. It favours companies operating in services, infrastructures, technologies and resources related to environmental sustainability.

It has returned 7.4 per cent over one year. Almost 50 per cent of the fund holdings are in the US. Among the top ten holdings are Aptiv Plc, an electric vehicle technology company, Westrock, a packaging company, and Asml Holding Nv, a leading chip-making company.

Liontrust Sustainable Future European Growth

The fund aims for long term capital growth and will principally invest in the shares of a broad range of European companies, based on the fund managers’ view of their long term return prospects. It only invests in companies that meet its rules for environmental and social responsibility. The top themes are energy efficiency and waste treatment and the biggest sector represented within the fund is financial services.

It’s top three holdings are DNB ASA, a Norwegian banking group, Danske Bank, the Danish bank and ASML, a Dutch chip-making specialist. It has returned 17.9 per cent over the last 12 months.

Sarasin Responsible Corporate Bond

Launched in November 2016, this bond fund seeks to achieve long term income and capital returns from a diversified portfolio of ethically screened corporate bonds and other credit instruments. The fund has returned 3.55 per cent on an annual basis since launch. Its three biggest holdings are the European Investment Bank, SNCF Reseau, the French rail operator, and Affordable Housing. Nearly 95 per cent of the fund’s holdings are based in the UK.